Feeling overwhelmed by Section 301 tariffs? You’re not alone! These powerful trade measures impact billions in imports, but we’ll break them down into bite-sized pieces you can easily understand.

In simple terms, Section 301 tariffs are additional taxes placed on imported goods from specific countries (especially China) when the U.S. believes those countries are engaging in unfair trade practices. The most notable Section 301 tariffs in recent years have been those imposed on Chinese imports, which began in 2018.

Transform complex trade regulations into actionable insights that drive business success. Our platform translates regulatory jargon into clear guidance tailored to your specific industry and markets. We stand behind our technology with a team of experienced trade professionals who understand your challenges. Explore our solutions and gain the competitive edge that comes with compliance confidence.

What Is Section 301 Tariffs Explained?

What is a Section 301 tariff? Section 301 tariffs are extra taxes the U.S. government imposes on imports from countries it believes engage in unfair trade practices. Think of them as America’s way of saying, “Play fair or pay more!” If you’re not still familiar with the concepts of what are customs duties and tariffs, you’re probably in a trouble finding your way!

These tariffs lead to a substantial increase in the cost of imported goods. Here, as an importer, you will face an additional tax, which has averaged around 25% of the total value of goods. For instance, importing $10,000 worth of goods with a 25% Section 301 tariff would result in an extra $2,500 in tax!! How’s that sound?

The Office of the United States Trade Representative (USTR) handles these investigations under the authority of the Trade Act of 1974. When they find a country isn’t following trade agreements or is harming U.S. commerce, they can hit back with these additional duties.

Four Waves of Tariffs on Chinese Imports

The tariffs rolled out in four major lists:

| List | Implementation Date | Value of Imports | Initial Tariff Rate | Current/Final Rate | Product Focus |

| List 1 | July 6, 2018 | $34 billion | 25% | 25% | Industrial tech, chemicals, machinery, electronics |

| List 2 | August 23, 2018 | $16 billion | 25% | 25% | Additional industrial materials and components |

| List 3 | September 23, 2018 | $200 billion | 10% | 25% (May 2019) | Nearly 8,000 products across multiple categories |

| List 4A | September 2019 | $300 billion | 10% | 7.5% (Feb 2020) | Consumer goods not covered in previous lists |

| List 4B | (Never implemented) | N/A | N/A | Suspended | Remaining subheadings |

Recent Developments in Section 301 Tariffs in China Heat Up the Trade War

The Biden administration didn’t back down. After a four-year review in 2024, they actually increased many tariffs:

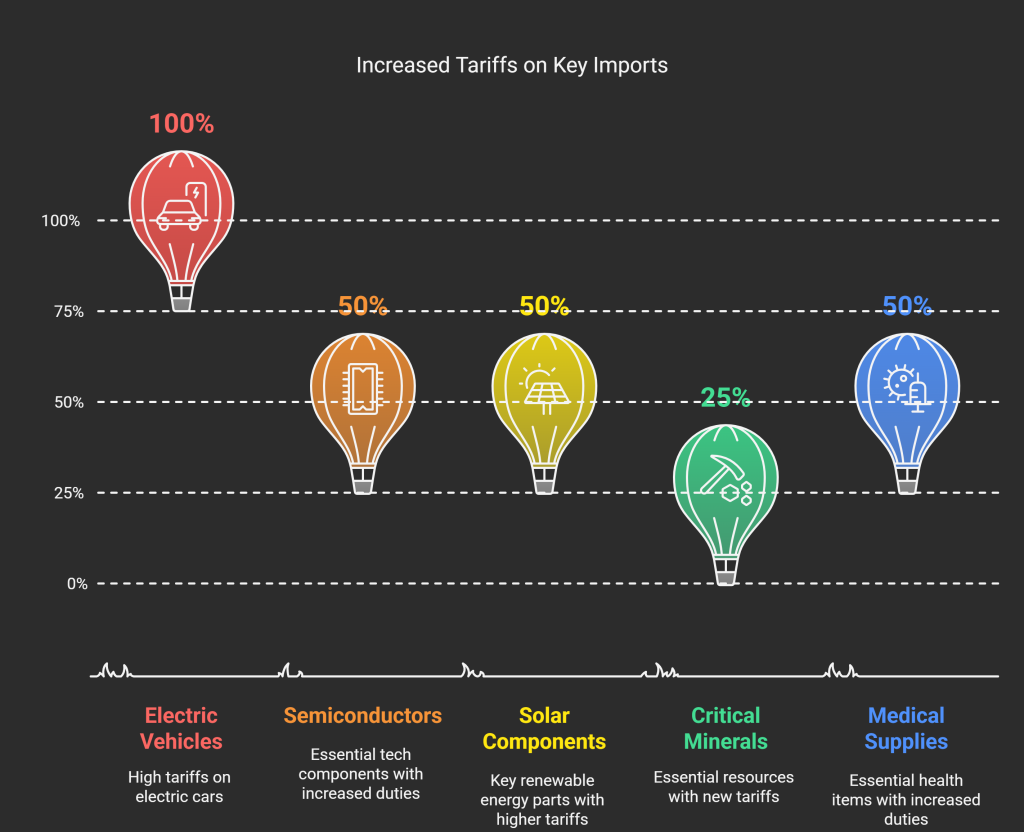

- Electric vehicles saw tariffs skyrocket to 100%

- Semiconductor tariffs jumped to 50%

- Solar component duties increased to 50%

- Critical minerals faced new 25% tariffs

- Medical supplies like face masks and syringes saw duties rise to 25-50%

In early 2025, the situation intensified further:

- The administration boosted the general tariff on Chinese products from 10% to 20%

- A separate executive order added another 20% duty on all Chinese imports

- Officials suspended the de minimis provision that previously allowed smaller shipments to avoid these tariffs

- The tariff timeline keeps evolving, with more increases scheduled for 2026 on items like lithium-ion batteries, natural graphite, and medical gloves.

Which Products Are Included in Section 301 Tariff List?

What is the Section 301 duties? The Section 301 tariffs cast a wide net, but certain industries face particularly steep duties:

1- Starting in 2024

| Product Category | Current Tariff Rate | Effective Date | Previous Rate |

| Electric vehicles | 100% | 2024 | 25% |

| Semiconductors | 50% | Jan 1, 2025 | 25% |

| Solar components (wafers, polysilicon) | 50% | Jan 1, 2025 | 25% |

| Syringes and needles | 50% | 2024 | 25% |

| Critical minerals (incl. tungsten) | 25% | Jan 1, 2025 | Various |

| Lithium-ion EV batteries | 25% | 2024 | 7.5% |

| Non-lithium-ion battery parts | 25% | 2024 | 7.5% |

| Ship-to-shore cranes | 25% | 2024 | 10% |

| Face masks | 25% | 2024 | Various |

| Steel and aluminum products | 25% | 2024 | 7.5-25% |

2- Starting in 2025

Under the Section 301 tariff action, you will also have to pay up to 50% tariff on Semiconductors from China.

3- Coming Soon in 2026

Here is a section 301list 3 tariff rate:

| Num. | Product | Increase Rate |

| 1 | Lithium-ion non-electrical vehicle batteries | 25% |

| 2 | Natural graphite | 25% |

| 3 | Permanent magnets | 25% |

| 4 | Medical gloves | 25% |

Which Products Are Excluded from Section 301 Tariffs USTR?

Not everything from China faces these steep tariffs. The USTR has granted several types of exclusions:

- 164 previously approved exclusions remain valid until May 31, 2025

- Temporary exclusions exist for 19 specific solar manufacturing equipment items

- A new exclusion process for machinery used in domestic manufacturing runs until March 31, 2025

- During COVID-19, many medical products received exclusions, though most expired in May 2024.

How Can I Avoid the Section 301 Tariffs?

Want to avoid paying these hefty tariffs? Consider these proven legally strategies:

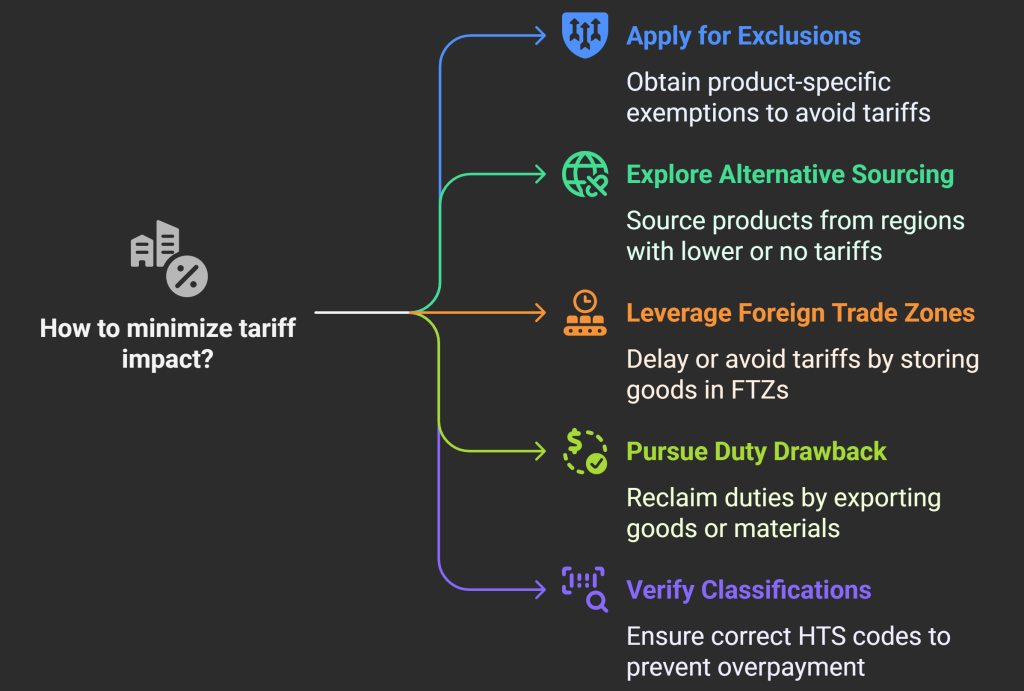

1- Apply for Exclusions

The USTR periodically opens windows for product-specific exemption requests. Success typically requires proving:

• Your product isn’t available elsewhere

• The tariffs cause significant economic harm

• The exclusion serves U.S. interests

2- Explore Alternative Sourcing

Products from Taiwan don’t face Section 301 tariffs. Hong Kong products are exempt from Section 301 duties specifically, though they still face the newer 20% blanket tariff.

3- Leverage Foreign Trade Zones

What is section 301 of the Trade Zones? You can store imports in FTZs or bonded warehouses to:

- Delay paying duties until products enter the U.S. market

- Avoid tariffs completely on goods you eventually re-export

4- Pursue Duty Drawback

You can also reclaim up to 99% of paid duties when you:

- Export the imported goods within three years

- Use imported materials in products you later export

- Return unused merchandise to foreign suppliers or destroy it properly

5- Verify Your Classifications

Now you should make sure that your products have the correct HTS codes—misclassification can mean unnecessary tariff payments. When in doubt, request formal classification rulings from U.S. Customs.

Stay Ahead and Win the Tariff Game

Don’t just react to tariff changes—anticipate and prepare for them!

The Section 301 timeline continues to evolve, from the initial 2017 investigation to the 2025 increases, and winners in this landscape think ahead. Work with our specialist AI Assistant to position your business advantageously before each new announcement hits. We’ll help you ensure classification accuracy, identify exclusion opportunities, and implement alternative strategies like FTZs and duty drawbacks.

How will upcoming tariff deadlines affect your imports? Do you have questions about the exclusion process closing on March 31st? Connect with us now for answers that put you ahead of competitors and in control of your tariff destiny.

What People Are Saying About the Section 301 Duties

- From r/Economics: “These tariffs are just a tax on American consumers. I’m paying more for everything from electronics to clothing, and I don’t see how this is helping American manufacturing return. Most companies just moved production to Vietnam or Thailand instead of the US.”

- From r/International Business: “My small business imports specialized components that simply aren’t made in the US anymore. The 301 tariffs have cut our margins to almost nothing, but we can’t raise prices without losing customers. It’s killing small businesses while big corporations can just absorb the costs.”

- From r/Politics: “Say what you will about the methods, but something needed to be done about China’s IP theft. The tariffs finally got their attention after decades of looking the other way. Short-term pain for long-term gain in protecting American innovation.”

- From r/Manufacturing: “We actually brought back some production to our Pennsylvania facility because of these tariffs. It’s not everything, but we’ve added 40 jobs in a community that really needed them. Sometimes protection works if you give it time.”

- Manufacturing Executive: “The Section 301 tariffs created unexpected complexity in our supply chain. We’ve spent thousands on consulting fees just to understand if our components fall under the various tariff codes. The compliance costs alone are a massive burden, regardless of the actual tariff payments.”

- Economics Professor: “Historical evidence suggests that tariffs rarely achieve their intended policy goals. While they may provide short-term protection for certain industries, they generally result in higher prices for consumers and businesses, retaliatory measures from trading partners, and overall economic inefficiency.”

- International Trade Lawyer: “My clients appreciate that the exclusion process exists, but it’s incredibly unpredictable. Two nearly identical products can receive completely different decisions. The lack of transparency in the exclusion process makes planning almost impossible for affected businesses.”

FAQ

1- How do I know if my products are subject to Section 301 tariffs?

You need to identify your product’s 8-digit or 10-digit Harmonized Tariff Schedule (HTS) code. Once you have this code (available from your supplier, distributor, or customs broker), you can search the USTR’s product search page or consult with a customs professional.

2- Can I still get an exclusion from Section 301 tariffs?

Yes, but opportunities are limited. Currently, the USTR is accepting exclusion requests only for machinery used in domestic manufacturing (under HTS Chapters 84 and 85) until March 31, 2025. The process requires detailed documentation about your product, why it deserves an exclusion, and how the tariffs impact your business.

3- Do Section 301 tariffs apply to small shipments or personal imports?

As of February 4, 2025, yes. The administration suspended the de minimis provision (Section 321) that previously allowed imports valued under $800 to enter duty-free from China.

4- If I assemble products in another country using Chinese components, do I still pay Section 301 tariffs?

This depends on the “substantial transformation” rule and country of origin determination. If the manufacturing process in the third country substantially transforms the Chinese components into a new product with different characteristics and uses, it may qualify as a product of that country instead of China, potentially avoiding Section 301 tariffs.

5- Which countries are currently affected by Section 301 tariffs?

While Section 301 tariffs primarily target China, the U.S. has also implemented or threatened similar tariffs against other countries including France (regarding digital services taxes), the EU (in the Boeing-Airbus dispute), and various other nations depending on specific trade disputes.

6- How much are the Section 301 tariffs? What are the rates?

Rates vary depending on the product category and which “list” they fall under:

- List 1 ($34 billion worth of imports): 25%

- List 2 ($16 billion worth of imports): 25%

- List 3 ($200 billion worth of imports): 25% (initially 10%)

- List 4A ($120 billion worth of imports): 7.5% (initially 15%)

7- Can Section 301 tariffs be avoided legally?

There are legal strategies to mitigate Section 301 tariffs, including: applying for exclusions (when available), product reclassification (if legitimate), supply chain restructuring (sourcing from non-tariffed countries), using foreign trade zones or bonded warehouses and duty drawback programs for re-exports.

8- How do Section 301 tariffs affect retail prices for consumers?

Studies show that most of the tariff costs are passed on to U.S. consumers through higher retail prices. Various analyses estimate price increases of 0.3% to 3% across affected consumer goods, with certain categories seeing significantly higher price jumps. The exact impact varies by industry, product type, and company size.

9- My exclusion request was denied. Can I appeal or reapply?

There is no formal appeals process for denied exclusion requests. However, during open comment periods, companies can resubmit applications with additional supporting evidence. The USTR periodically reopens the exclusion process, though timing is unpredictable and depends on administrative priorities.

10- Are there any automatic exemptions from Section 301 tariffs?

Very few automatic exemptions exist. Some medical supplies received temporary exemptions during the COVID-19 pandemic. Additionally, products that qualify under “de minimis” rules (currently shipments valued under $800) can enter duty-free, though there are ongoing discussions about changing these thresholds.

11- What’s the difference between Section 301 tariffs and Section 232 tariffs?

Section 301 tariffs target unfair trade practices, while Section 232 tariffs are implemented on national security grounds. Section 232 tariffs primarily affect steel and aluminum imports from various countries, while Section 301 tariffs primarily target a broad range of Chinese goods based on intellectual property concerns.

12- Will Section 301 tariffs be removed soon?

The fate of Section 301 tariffs depends largely on political factors and U.S.-China relations. The Trump administration initiated them, the Biden administration maintained most while reviewing the program, and the second Trump administration is likely to continue or potentially expand them. Regular USTR reviews determine whether they remain justified under the original rationale.

13- How do I calculate Section 301 tariffs for my imports?

The Section 301 tariff is calculated as a percentage of the customs value of the goods. For example, if you’re importing $100,000 worth of products subject to a 25% Section 301 tariff, you would pay $25,000 in Section 301 duties in addition to any regular duties that apply to those products.

14- Do Section 301 tariffs apply to goods that were already in transit when they were announced?

Typically, Section 301 tariffs apply based on the date of entry into the U.S., not the shipping date. This means goods already in transit when tariffs are announced or increased will be subject to the tariffs in effect on the date they clear customs in the U.S.

15- What happens if I misclassify my products to avoid Section 301 tariffs?

Intentional misclassification to avoid tariffs is considered customs fraud and can result in: significant financial penalties (up to the domestic value of the merchandise), seizure of goods, loss of import privileges, criminal prosecution in serious cases even unintentional errors can result in penalties and back payments.

16- How are Section 301 tariffs different from antidumping or countervailing duties?

Section 301 tariffs address unfair trade practices broadly, while antidumping duties target specific products sold at unfairly low prices, and countervailing duties address specific foreign government subsidies. Section 301 tariffs are applied across broad categories of goods, while antidumping and countervailing duties target specific products from specific manufacturers based on case-by-case investigations.

17- Can I get a refund on Section 301 tariffs I’ve already paid if exclusions are granted retroactively?

Yes, if an exclusion is granted that covers products you’ve imported, you can typically file for refunds of Section 301 tariffs already paid, provided you do so within the specified timeframe (usually within 180 days of the exclusion being granted). This process is handled through U.S. Customs and Border Protection’s protest mechanism or Post Summary Correction process.