What does custom clearance mean in shipping? in simple terms, every time goods cross a border, they need to go through customs clearance. Think of it as a country’s checkpoint where officials make sure everything entering or leaving follows the rules.

What happens during customs clearance process? Customs authorities inspect your items, verify they comply with local laws, calculate any taxes owed, and then release your goods to continue their journey. It’s their way of keeping everyone safe and making sure the proper duties get paid.

Navigating international shipping doesn’t have to give you headaches! Streamline your import operations with our AI compliance platform. Join hundreds of businesses that have eliminated penalties and simplified their international trade. Our comprehensive solution adapts to your specific needs, ensuring you stay ahead of changing regulations. Schedule a demo today and discover how we can transform your compliance challenges into opportunities.

What Does Custom Clearance Mean?

Whether you’re a seasoned importer/exporter or just starting your global business journey, we all know that customs clearance can make or break your shipping timeline.

Necessary Documents for Completing Customs Clearance

Let’s cut to the chase—these five documents form the backbone of almost every customs clearance process worldwide:

| Document | Purpose | Why It Matters to You |

| Commercial Invoice | Details the transaction, including goods description, quantity, value, and buyer/seller information | Customs uses this to calculate duties and taxes—accuracy here saves you money! |

| Packing List | Outlines contents of each package, specifying items, quantities, dimensions, and weight | Makes physical inspections faster and reduces the risk of delays |

| Bill of Lading | Serves as receipt from carrier and outlines transportation contract terms | Your proof that the carrier accepted your goods in good condition |

| Certificate of Origin | Certifies the country where goods were manufactured | Can qualify you for preferential tariff rates under trade agreements |

| Customs Declaration | Provides detailed information about imported/exported goods | The formal document that initiates the customs clearance process |

However, depending on your cargo, destination, and shipping method, you’ll need additional documentation. Think of these as your specialized tools for particular shipping scenarios:

| Document | When You’ll Need It | Pro Tip |

| Air Waybill | For air freight shipments | Contains tracking details—keep a copy handy for real-time status checks |

| Proforma Invoice | Before finalizing the shipment | Helps your buyer secure import approvals and arrange payment in advance |

| Insurance Certificate | For valuable or high-risk cargo | Request “all-risk” coverage for comprehensive protection |

| Transportation Invoice | When shipping costs are billed separately | Keep this handy for accurate landed cost calculations |

| Pre-shipment Inspection Certificate | For regulated goods or certain destination countries | Schedule inspections early to avoid last-minute scrambling |

| Certificate of Free Sale | For food, cosmetics, and health products | Obtain this from your industry regulatory body before export |

| Shipper’s Letter of Instruction | When using a freight forwarder | Be detailed—this document shapes how your shipment moves |

| Letter of Credit | For new business relationships or high-value shipments | Specify exact document requirements to prevent payment delays |

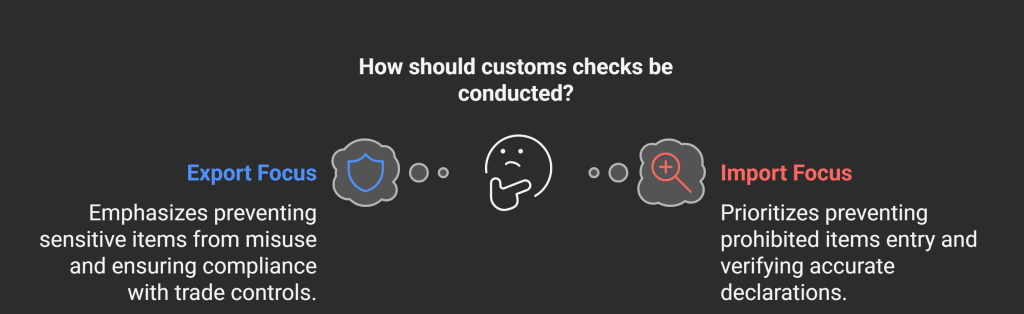

Import vs. Export Customs Checks: What’s the Difference?

Did you know customs officials look for different things when goods leave versus when they enter a country?

Export Customs Focus:

I’ll help you navigate export controls that prevent sensitive items from falling into the wrong hands. Export authorities check that regulated items like computers, textiles, and measuring devices—which could potentially serve military purposes—follow proper trade control orders.

Import Customs Focus:

When bringing goods into a country, expect stricter scrutiny. Import authorities will verify:

- Your shipment contains no prohibited items (like illegal drugs)

- You’ve correctly declared the product origin

- Your tax declarations match the actual value

Pro tip: Import inspections typically run more stringent than export checks because countries prioritize protecting their borders and collecting proper revenue.

How Long Will Customs Clearance Take?

How long after clearing customs to delivery? Good news! Most shipments clear customs in less than 24 hours. But keep in mind that various factors can extend this timeline:

- If your goods get flagged for inspection

- During busy shipping seasons

- When shipping regulated products

- If your paperwork has issues

The best way to ensure quick clearance? Prepare accurate documentation from the start!

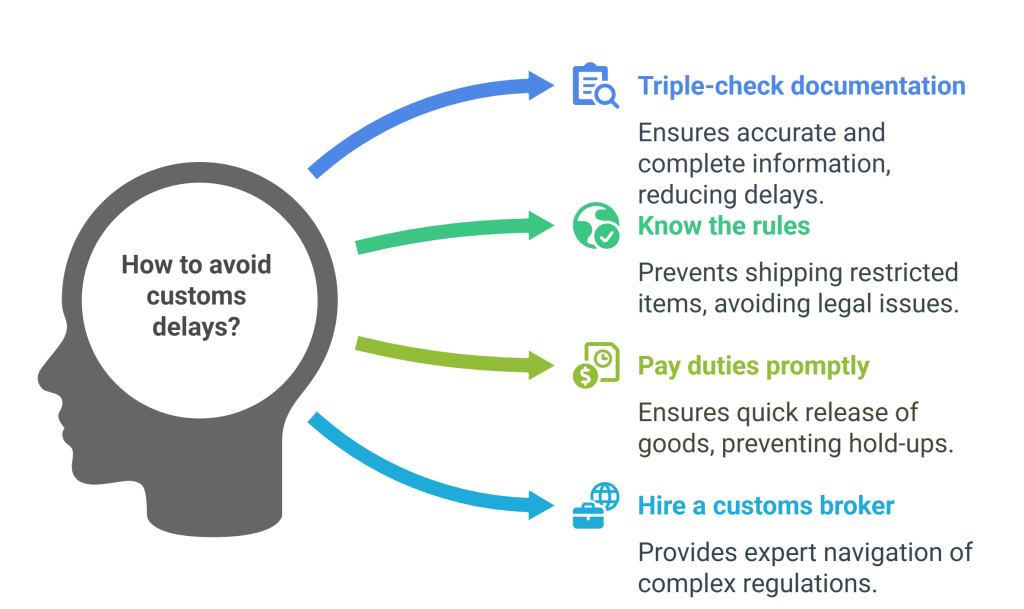

How Can You Avoid Customs Delays?

Nobody likes waiting for their packages! Here’s how to avoid getting stuck at customs:

- Triple-check your documentation: Most delays happen because of missing or inaccurate information. List everything correctly, including values, descriptions, and country of origin.

- Know the rules: Each country has different import regulations. Something perfectly legal to ship from your country might be restricted at the destination.

- Pay duties promptly: Customs won’t release your goods until all fees are paid. Be prepared to handle these costs quickly.

- Consider hiring a customs broker: These professionals know the ins and outs of customs regulations and can navigate complex situations for you.

- Be inspection-ready: Your shipment might get selected for a physical inspection. Make sure everything matches your declaration!

Who Pays Customs Charges?

One you find out “What does custom clearance mean“, you need to find the answer to this question: ” Who pays customs charges?” In commercial shipping, the importer or consignee typically pays customs charges. However, the responsible party must be pre-agreed and clearly specified in the contractual Incoterms.

Your Customs Success Action Plan

- Prepare early: Begin document preparation at least 3-5 days before shipping.

- Check for consistency: Ensure all information matches exactly across all documents.

- Keep digital copies: Store accessible digital versions of all documents.

- Consider professional help: A customs broker can prevent costly mistakes, especially when entering new markets.

- Stay updated: Trade regulations change frequently—subscribe to customs authority notifications.

Now you tell me! What does custom clearance mean? Remember, every discrepancy between your documents and actual shipment can trigger investigations and delays. I’ve seen simple typos cost companies thousands in storage fees and late delivery penalties.

Don’t hesitate to reach out with questions about your specific shipping needs! Together, we’ll ensure your products cross borders efficiently while keeping you compliant with international trade laws.

FAQ

1- What does custom clearance mean?

The process of getting legal permission from authorities to move goods across international borders. It involves documentation, payment of duties/taxes, and compliance with import/export regulations.

2- Who is responsible for customs clearance?

The importer of record (IOR), though many hire customs brokers or freight forwarders to handle the process professionally.

3- What documents are required for customs clearance?

Commercial invoice, packing list, bill of lading/airway bill, certificate of origin, import license (if applicable), insurance certificate, customs declaration form, and any product-specific certificates.

4- How long does customs clearance take?

Typically ranges from a few hours to several days, depending on the country, goods type, documentation completeness, and whether inspection is required. Express shipments may clear in hours; complex commercial shipments can take 2-7 days.

5- What are customs duties and how are they calculated?

Taxes on imported goods calculated using: Duty amount = Customs value × Duty rate (%). Rates depend on product classification (HS code) and country of origin.

6- What is a Harmonized System (HS) code?

An internationally standardized numerical classification system for traded products. The first 6 digits are international standards, with additional country-specific digits. Used to determine applicable duties and regulations.

7- Can customs clearance be done in advance?

Yes, many countries offer pre-arrival customs clearance. Submitting documentation before goods arrive reduces processing time and helps avoid delays and storage charges.

8- What happens if my shipment is held by customs?

You’ll receive notification explaining the reason (documentation issues, payment problems, compliance concerns, or random inspection). Respond promptly by providing requested information or addressing issues to release your shipment.

9- What is a customs broker and do I need one?

A licensed professional specializing in customs procedures. While not always legally required, brokers are recommended for first-time importers, irregular shipments, complex goods, or products with special regulations.

10- What are common reasons for customs delays?

Incomplete documentation, incorrect classification, missing valuation information, inadequate description of goods, non-compliance with regulations, random inspections, port congestion, or missing permits/licenses.

11- How can I track my shipment during customs clearance?

Through carrier tracking systems, customs online portals (where available), updates from your customs broker, or EDI systems for commercial shipments.

12- What is de minimis value?

A threshold set by countries below which imported goods are exempt from duties and taxes. Varies by country ($800 US, €150 EU). Shipments below this value generally clear faster with less paperwork.

13- What are special customs procedures?

Alternatives like bonded warehouses (duty-deferred storage) and free trade zones (areas considered outside customs territory where goods can be handled without immediate duty payment). These options provide financial and procedural benefits.

14- How do personal vs. commercial shipments differ for customs?

Personal shipments involve simplified documentation, lower scrutiny, possible duty exemptions, and self-clearance options. Commercial shipments require comprehensive documentation, proper classification, accurate valuation, full compliance, and often a customs broker.

15- What are formal vs. informal customs entries?

Formal entries are for higher-value shipments ($2,500+ in US), requiring detailed documentation, complete examination, and typically a customs broker. Informal entries are for low-value shipments with simplified documentation and faster processing.

16- How do I handle customs for restricted goods?

Identify regulations beforehand, obtain required permits/licenses, ensure proper labeling/packaging, consider specialized brokers, expect longer clearance times, and be prepared to provide additional documentation.

17- What are penalties for customs violations?

Varies by country but may include fines, seizure of goods, revocation of import/export privileges, criminal prosecution for serious violations, increased inspection rates, and back payment of evaded duties plus interest.

18- How do I calculate total landed cost?

Sum of: purchase price, shipping, insurance, duties, taxes (VAT/GST), customs fees, broker fees, handling charges, warehousing costs, compliance testing, and delivery charges.