What is HS code? How can I look up HS code? HS code stands for Harmonized System code and is a global product classification system. Have you ever wondered how products seamlessly cross international borders? Behind every international shipment lies a complex system of product classification that keeps global trade running smoothly.

Secure your international operations with enterprise-grade compliance technology that scales with your business. Our platform delivers the confidence you need to enter new markets and expand your global footprint. We’ve built lasting partnerships with businesses that value both innovation and regulatory precision. Get started today and make compliance your competitive advantage in the international marketplace.

What Is HS Code?

What Is HS Code in Shipping? The Harmonized System (HS) code serves as the worldwide language for classifying traded products. Think of it as the universal translator for global commerce! Customs authorities worldwide use this standardized numerical method to identify products when they assess duties and taxes and gather statistics.

The World Customs Organization (WCO) publishes this nomenclature, allowing customs officials to recognize traded goods in a consistent way across borders. The first six digits in an HS code are standardized and used by both US Customs and all other WCO member countries.

What Is an HTS Code?

The Harmonized Tariff Schedule (HTS) code, also called the HTSUS code, is the system specifically used to classify goods imported into the United States. It builds on the global HS code system but adds important US-specific details.

When importing goods into the USA, you must use the HTS code – not just the international HS code. US Customs and Border Protection (CBP) will use your product’s HTS code to apply import duties, anti-dumping duty, trade war tariffs, and any other related fees and requirements.

The HTS code consists of two parts:

- The first six numbers (which match the international HS code)

- An additional one to four digits that specify US-specific tariff classifications

Each unique HTS code comes with different import duty rates and specific import requirements.

HS vs. HTS Codes: Similarities and Differences

Let me break down how these systems compare:

| Aspect | HS Codes | HTS Codes |

| Purpose | Classification of traded products worldwide | Classification of goods imported into the US |

| Administrator | World Customs Organization (WCO) | United States International Trade Commission |

| Usage | Used by customs authorities globally | Used specifically by US Customs and CBP |

| Structure | 6-digit code (universal) | 10-digit code (first 6 digits match HS code + 4 US-specific digits) |

| Application | Identifies products, assesses duties, gathers statistics | Determines US-specific import duties, tariffs, and requirements |

| Specificity | Broader international classification | More detailed US-specific classification |

| Updates | Typically updated every 5 years by WCO | May have more frequent US-specific updates |

How to Calculate HS Code? Structure of HS Codes!

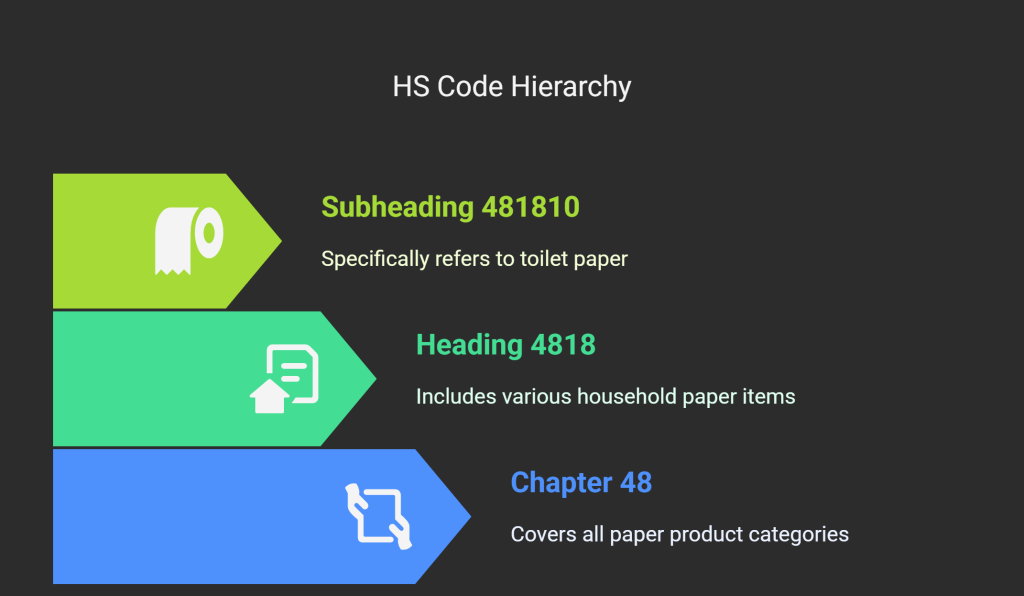

HS codes follow a logical, top-down structure that becomes increasingly specific. Let me show you how this works:

- Sections – The broadest category (21 total sections)

- Chapters – More specific groupings (99 chapters)

- Headings – Detailed product categories (1,244 headings)

- Subheadings – The most precise classifications (5,224 subheadings)

How many digits is a harmonized code? Technically 6 digits. HS codes follow a logical hierarchical structure that gets increasingly specific. Let me show you how they break down:

- First 2 digits: Identify the chapter (broad category)

- Next 2 digits: Identify headings within that chapter

- Final 2 digits: Identify subheadings for even more specific classification

This hierarchical approach makes perfect sense when you see it in action. what is an example of HS code? Take toilet paper rolls, for example. They fall under:

• Chapter 48 (paper products)

• Heading 4818 (household paper items)

• Subheading 481810 (toilet paper specifically)

HS Code Example

Is HS Code Similar Across All Countries?

While the first six digits remain consistent worldwide, countries add their own unique digits beyond that. Let’s explore these variations:

| Country System | Structure | Special Features |

| U.S. Schedule B (Export) | 10 digits | Additional Chapter 98 for special U.S. provisions |

| U.S. HTS (Import) | 10 digits | Country-specific tariff classifications |

| EU Combined Nomenclature | 8 digits | European-specific classifications |

| China Customs Commodity Code | 10 digits | Chinese-specific classifications |

| Japan Statistical Code | 9 digits | Japanese-specific classifications |

These differences highlight why you need to know both your domestic code and the importing country’s code for successful international trade.

Want to find the correct foreign country HS code? You have several options:

- Use a foreign tariff look-up tool

- Request an “advance ruling” from the importing country’s customs agency

- Consult with a customs broker who specializes in the destination country

Remember, using the correct foreign country HS code helps you identify applicable tariffs and taxes, determine full landed costs, qualify for free trade agreements, and complete shipping paperwork for smooth imports.

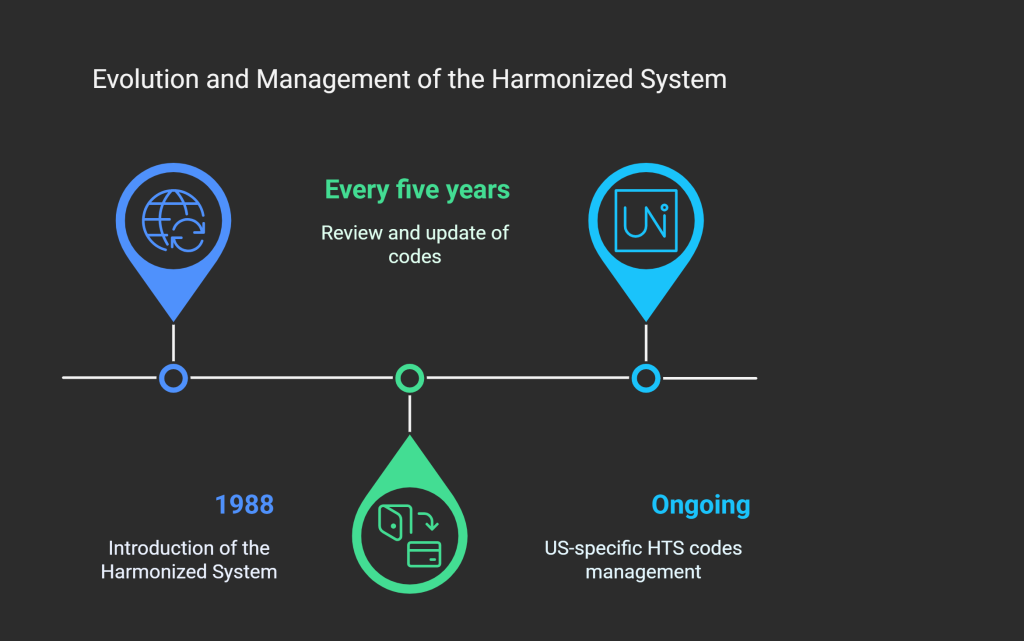

Who Maintains HS Codes?

The World Customs Organization (WCO) develops and maintains the Harmonized System, which first came into effect in 1988. They review and update the codes approximately every five years to keep up with changes in technology, trade patterns, and international commerce needs.

For the US-specific HTS codes, the United States International Trade Commission oversees the system, making necessary adjustments to align with both international standards and US trade policy requirements.

What Happens If I Get My HS Code Wrong?

Using the correct HS and HTS codes isn’t just about compliance—it directly impacts your bottom line! Incorrect codes can lead to:

- Unexpected duties and taxes

- Customs delays and storage fees

- Potential penalties for misclassification

- Missing out on free trade agreement benefits

Taking the time to properly classify your products pays dividends in smoother customs clearance and potentially lower duty rates. Think of these codes as your passport to successful global trade. When you understand and apply them correctly, you remove a significant barrier to international business growth.

How Can You Stay Current with Code Changes?

Remember that both HS and HTS codes change periodically. The WCO typically updates the international system every five years, with the most recent major revision occurring in 2022. Individual countries may update their extended codes even more frequently.

Make it a habit to periodically review the codes you use most often. What worked last year might not work this year, and using outdated codes can lead to customs delays, unexpected costs, or even rejected shipments.

Have you encountered challenges with HS or HTS codes in your international shipping? Mastering this system takes practice, but it becomes second nature with experience. Start by focusing on the codes for your most commonly shipped products, and you’ll build confidence in navigating this essential aspect of global trade.

FAQ

1- How do I find the correct HS code for my product?

You can find your product’s HS code by consulting the WCO’s HS classification database, using online search tools provided by customs agencies, or working with a customs broker.

2- What’s the difference between 6-digit, 8-digit, and 10-digit codes?

The first 6 digits are internationally standardized (the true HS code), while digits 7-10 are country-specific additions. The first 6 digits are universal and recognized globally. Additional digits represent country-specific subcategories. For example, the US uses 10 digits total (HTS code), while the EU uses 8 digits (CN code).

3- Can I use the same HS code for every country I export to?

No. While the first 6 digits remain consistent worldwide, each country may add their own additional digits, creating a different final code. Always check the importing country’s full code.

4- What happens if I use the wrong HS code?

Using an incorrect HS code can lead to delayed shipments, incorrect duty payments, fines, penalties, or even seized goods.

5- How often do HS codes change?

The WCO updates the HS nomenclature approximately every 5 years, with the most recent major update implemented in 2022.

6- Do services require HS codes or just physical goods?

HS codes primarily apply to physical goods. Services typically don’t require HS codes, though some digital products that can be downloaded may need them.

7- Can the same product have different HS codes based on its use?

Yes, products can be classified differently based on their intended use, composition, or specific characteristics. For example, if you make plastic containers for food storage, laboratory use, or general household organization, they will all get different HS codes depending on whether they’re marketed.

8- Who has the final say on the correct HS code for my product?

The customs authority of the importing country has the final authority on classification. You can argue all day about what you think the code should be, but ultimately, the customs officials where you’re sending your goods make the call. Getting an advance ruling can prevent headaches.

9- Do HS codes affect eligibility for free trade agreements?

Answer: Absolutely. Free trade agreement benefits often depend on specific HS code classifications and origin requirements.

10- Can small businesses or occasional exporters ignore HS codes?

No, HS codes are required regardless of business size or frequency of shipments.

11- Is there software that can help assign HS codes automatically?

Yes, there are product classification tools and trade management software that can suggest HS codes, though human verification is still recommended.

12- Do HS codes differ for used/refurbished goods versus new products?

Generally, used or refurbished goods use the same HS codes as new items, but duties and restrictions may differ.

13- Can I use one blanket HS code for a shipment with multiple products?

No, each distinct product requires its own classification. Each line item on your commercial invoice needs its own HS code. Trying to lump different products under one code is a major red flag for customs audits and can result in penalties.

14- Will HS codes eventually be replaced by a new system?

There’s no indication that the HS system will be replaced anytime soon, though it continues to evolve.