Soybeans: A Global Import Market Analysis

By John P. LaWare

Introduction

As a seasoned market analyst who has followed agricultural commodity markets for decades, soybeans have long been on my radar as one of the world’s most widely traded and economically important crops. Soybeans are a critical source of protein for both human food and animal feed, as well as the raw material for soybean oil and other products. The global trade in soybeans is massive, with millions of tonnes shipped across oceans each year to satisfy the protein and vegetable oil needs of populations worldwide.

Soybean Key Importers

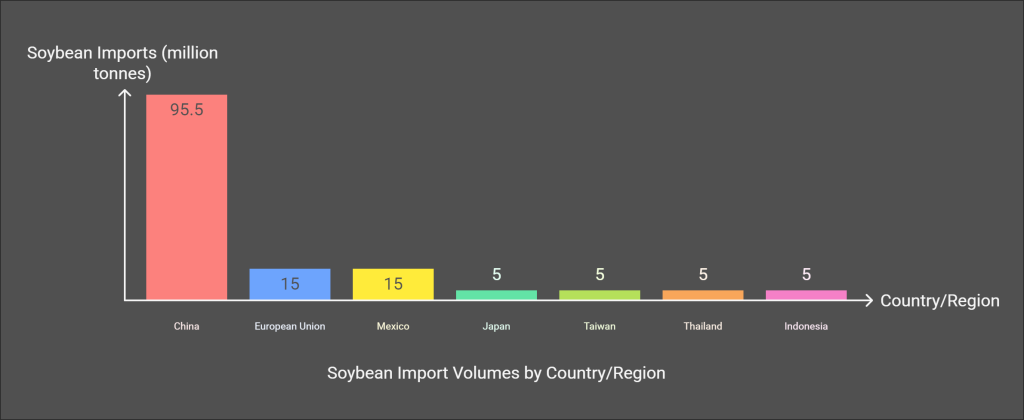

China is by far the world’s largest soybean importer, accounting for over 60% of total global soybean trade.[1] China’s soybean imports have skyrocketed from around 15 million tonnes at the turn of the millennium to a record 95.5 million tonnes in 2020.[2] The driver behind China’s enormous appetite for soybeans is the need to feed its growing population and livestock herds. Soybeans are crushed to produce meal, the key protein ingredient in animal feed.

The European Union is the second largest importer at over 15 million tonnes annually.[3] Significant quantities also flow to Mexico, Japan, Taiwan, Thailand, Indonesia and other countries across Asia and the Americas.

Argentina, itself a major soybean producer, is an interesting case. It imports whole soybeans from neighboring Paraguay and then processes and re-exports the soymeal and oil.[4] This crushes added about $650 million in value to Argentina’s soybean industry in 2020 according to the USDA.[5]

Soybean Suppliers Feeding the Global Market

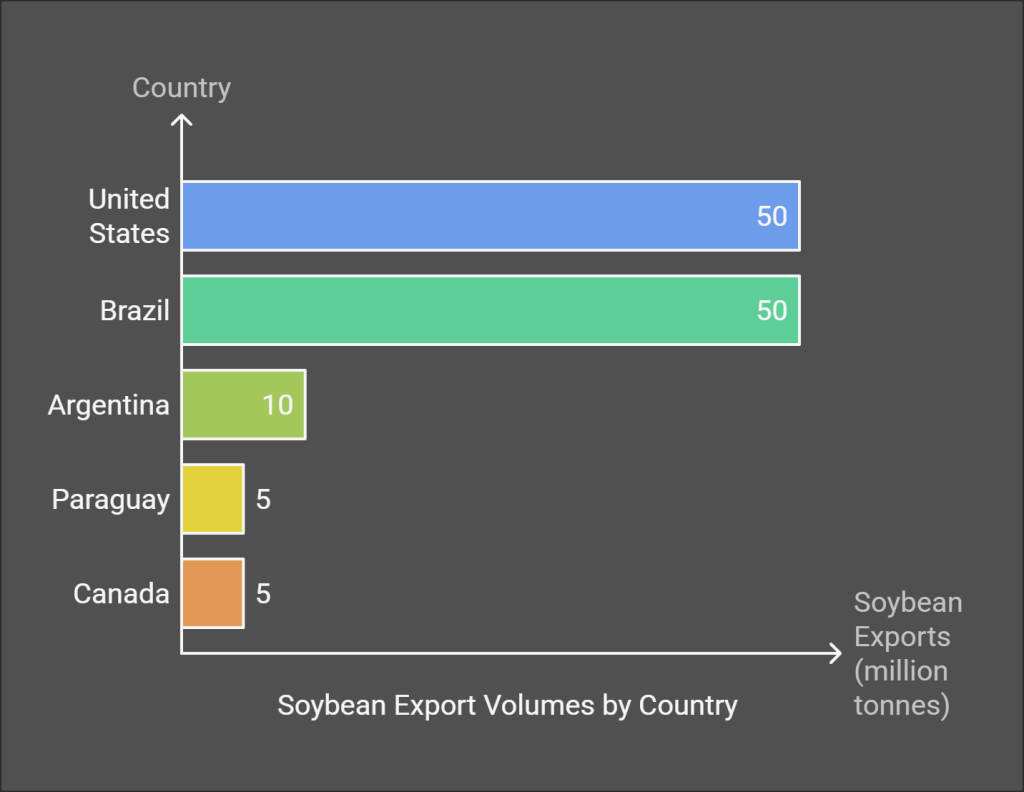

The US, Brazil and Argentina are the “big three” producers and exporters of soybeans globally. The US and Brazil each export over 50 million tonnes per year, while Argentina exports over 10 million tonnes of soybeans plus large quantities of soy products.[6]

In the US, soybeans are the second most planted field crop by acre after corn.[7] “We expect US soybean exports to grow substantially as a new trade deal with China ramps up demand,” according to US Secretary of Agriculture Sonny Perdue in 2020.[8]

Brazil has emerged as an agricultural superpower and the top soybean exporter, aided by its vast arable interior suited to soybean cultivation. “Brazil’s soybean industry will continue to expand to meet strong global demand,” said Marcello Brito, President of the Brazilian Agribusiness Association last year.[9]

Meanwhile, Paraguay and Canada are significant second-tier exporters. Both ship several million tonnes per year, mainly to niche regional markets.[10]

Pricing and Dealing

Soybean prices are set by the Chicago Board of Trade (CBOT), with the benchmark contract quoted in cents per bushel.[11] Prices can swing dramatically based on weather, trade policy, exchange rates and other factors. I still remember the market mayhem in 2018 when China imposed retaliatory tariffs on US soybeans during the trade war – CBOT prices plunged over 20%![12]

Conclusion

The complex web of soybean trade ties far-flung producers and consumers together into an integrated global market. While there are risks of trade disruption and dislocations, the underlying demand for this humble legume and its derived products remains robust. For more insights on the ins-and-outs of the soybean trade, I recommend this explainer video: The Soybean Saga.

The global soybean market will no doubt continue to evolve, but the central role of this crop in the world food system appears secure. I’ll be watching prices on the CBOT and the latest export figures to discern the future trends in this fascinating market.

John P. LaWare

JPL Market Insights

References:

[1] https://oec.world/en/profile/hs92/soybeans

[2] https://www.world-grain.com/articles/14428-focus-on-china-soybean-imports-hit-record-high-in-2020

[3] https://ussec.org/resources/

[4] https://www.agriculture.com/markets/newswire/argentina-soy-crushers-object-to-governments-pland-for-higher-export-taxes

[5] https://www.fas.usda.gov/data/argentina-oilseeds-and-products-annual-6

[6] https://apps.fas.usda.gov/psdonline/circulars/oilseeds.pdf

[7] https://www.nass.usda.gov/Statistics_by_Subject/result.php?8FC1D235-83C1-3EE1-A71A-CB99C9430FAE

[8] https://www.reuters.com/article/usa-trade-china-perdue-idUSL1N29R1RS

[9] https://www.reuters.com/article/brazil-soy-outlook-idUSL1N2BO22Q

[10] https://ussoy.org/wp-content/uploads/2020/08/Top-10-U.S.-Soy-Markets-as-of-MY2020.pdf

[11] https://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean.html

[12] https://www.cnbc.com/2018/07/05/soybean-prices-plunge-to-nine-year-low-on-us-china-trade-war-fears.html

Essential Topics You Should Be Familiar With: