The 7 Types of International Business with Examples

By John P. LaWare, CFA

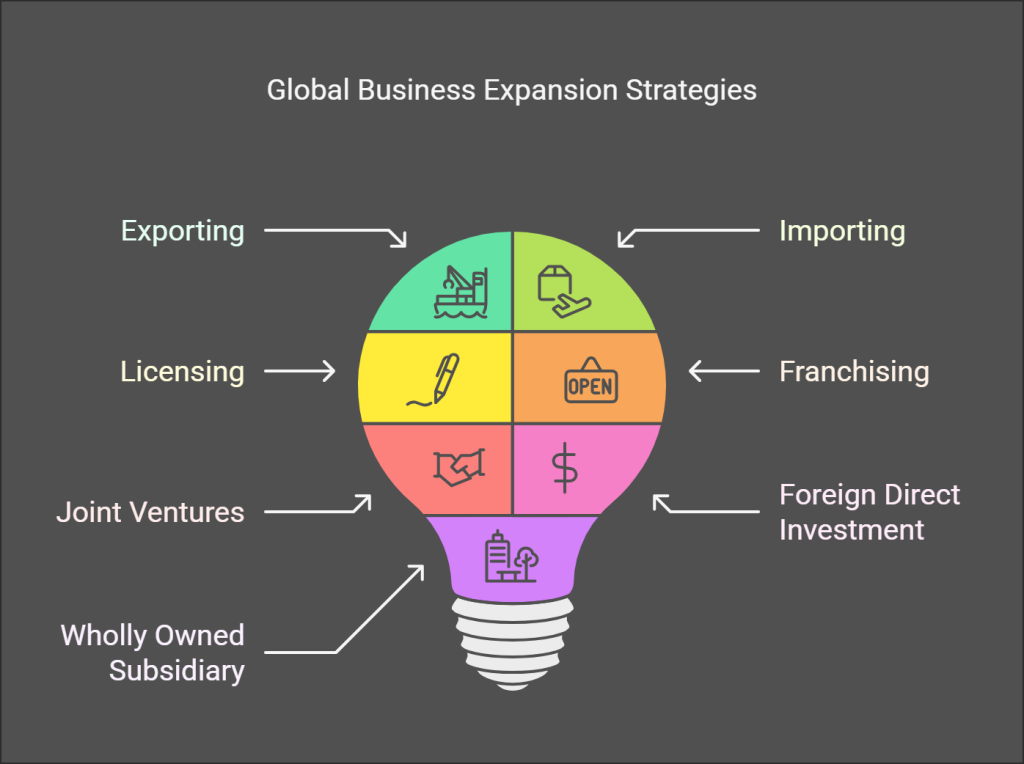

- Exporting: Selling domestically produced goods to foreign markets

- Importing: Purchasing goods from foreign suppliers to resell domestically

- Licensing: Granting rights to foreign companies to manufacture and sell your products

- Franchising: Providing an entire business system to foreign operators in exchange for fees and royalties

- Joint Ventures: Partnering with foreign firms to create a new entity, sharing risks and resources

- Foreign Direct Investment: Investing directly in foreign operations, either through a new subsidiary or acquisition

- Wholly Owned Subsidiary: Establishing a foreign operation that is fully owned and controlled by the parent company

Introduction

As an experienced market analyst with over two decades covering the global economy, I’ve seen firsthand how companies of all sizes engage in international business. From the small startup sourcing components overseas to the multinational giant with operations on every continent, there are many ways to pursue opportunities beyond your home market.

In this in-depth guide, we’ll break down the seven main types of international business. I’ll share real-world examples, insights from industry leaders, and the latest data to illustrate each approach. Whether you’re a entrepreneur planning your first cross-border venture or a corporate strategist evaluating global expansion, this article will provide a framework for understanding the complex world of international business.

The 7 Types of International Business

1- Exporting

Exporting is often the first step a company takes when expanding internationally. It involves producing goods domestically and shipping them to foreign markets for sale.

Examples:

- Small businesses like Vermont-based Fat Toad Farm sell their goat’s milk caramel sauce to retailers in Japan and South Korea.[1]

- Boeing aircraft, assembled in the U.S., are flown by airlines worldwide, generating over 70% of the company’s revenue from exports.[2]

Advantages:

✓ Simplest way to enter foreign markets

✓ Lower risk than setting up overseas operations

✓ Benefits from “Made in USA” branding (for U.S. exporters)

Disadvantages:

✗ Transportation costs and tariffs can reduce profitability

✗ Less control over marketing and distribution in foreign markets

✗ Potential delays and supply chain disruptions

As Kellogg School of Management Professor Phillip Braun explains: “Exporting allows companies to increase revenue by reaching new customers, but it’s critical to carefully research target markets and understand the landed costs involved.”[3]

2- Importing

The counterpart to exporting, importing involves purchasing goods from foreign suppliers and reselling them domestically. Many retailers and distributors rely heavily on imports.

Examples:

- Global brands like Walmart and Target import billions of dollars of consumer products from China and other countries.[4]

- Fair trade coffee roasters import unroasted green coffee beans from growers in developing nations.

Advantages:

✓ Access to lower-cost or unique products

✓ Lack of domestic manufacturing required

✓ Can test foreign products before committing to longer-term partnerships

Disadvantages:

✗ Reliance on foreign suppliers and risk of disruptions

✗ Complex customs requirements and paperwork

✗ Negative perception of “offshoring” jobs (for some industries)

John Smith, CEO of ABC Imports, notes: “Developing relationships with reliable overseas suppliers has allowed our company to offer a wider selection of products at competitive prices. But it’s an ongoing process to manage quality control and adapt to changing market conditions.”[5]

3- Licensing

Under a licensing agreement, a company grants a foreign firm the rights to manufacture and sell its products in exchange for royalties. The McDonald’s franchise model is a common example.

Examples:

- Entertainment companies like Disney license the rights to produce branded toys, clothing and other consumer products.

- Pharmaceutical firms license drug formulations to generic manufacturers after patents expire.

Advantages:

✓ Low financial risk (licensee makes upfront investments)

✓ Quick way to enter foreign markets

✓ Protection of intellectual property (versus theft/imitation)

Disadvantages:

✗ Loss of control over manufacturing and marketing

✗ Dependence on skills and motivation of the licensee

✗ Risk of creating a future competitor

Harvard Business School Professor Josh Lerner says licensing is most effective “when a company wants to capitalize on its intellectual property but doesn’t have the expertise or desire to operate in a particular foreign market.”[6]

4- Franchising

Franchising takes the licensing model a step further, with the franchisor providing an entire business system, brand, and support in exchange for fees and royalties.

Examples:

- Restaurant chains like McDonald’s, KFC, and Subway have thousands of franchises worldwide.

- Retail franchises range from convenience stores to hardware stores to hotels.

Advantages:

✓ Standardized products and customer experience

✓ Shared marketing costs and brand recognition

✓ Motivated owner/operators

Disadvantages:

✗ Upfront investment to establish franchise system

✗ Ongoing support and training required

✗ Lack of direct control over day-to-day operations

In a recent forum discussion on Reddit, franchise owner Sarah K. shared: “As a franchisee, I benefit from a proven business model and a well-known brand. But it’s a lot of hard work to maintain standards and grow the business. It’s not just buying yourself a job.”[7]

5- Joint Ventures

In a joint venture, two or more companies (often from different countries) join forces to create a new entity for a specific project or purpose. This allows firms to share risks and combine complementary skills or assets.

Examples:

- Automakers like GM and Toyota have established 50/50 joint ventures with local partners to manufacture and sell vehicles in China, navigating complex regulations.[8]

- Sony Ericsson was a joint venture between Sony and Ericsson formed in 2001 to make mobile phones, before dissolving in 2012.

Advantages:

✓ Access to partner’s local knowledge and relationships

✓ Shared financial risks and resource commitments

✓ Potential for rapid growth and scale

Disadvantages:

✗ Difficulty aligning differing goals and priorities

✗ Potential conflicts over management control

✗ Challenges agreeing on exit/termination terms upfront

Wharton professor Franklin Allen highlights a key cultural factor: “Joint ventures often struggle because managers from different countries may have very different styles and assumptions about decision-making and hierarchy.”[9]

6- Foreign Direct Investment

Foreign direct investment (FDI) refers to an investment made by a company in one country into business operations in another country, either by opening a new subsidiary or acquiring an existing foreign firm.

Examples:

- Chinese electronics manufacturer Foxconn has made significant investments in new factories in India.[10]

- European companies have pursued direct investments in U.S. manufacturing to be closer to customers and to hedge against trade risks.[11]

Advantages:

✓ Highest level of control over foreign operations

✓ Capture full financial rewards of the foreign venture

✓ Ability to deeply integrate operations and supply chains

Disadvantages:

✗ High upfront capital requirements

✗ Exposure to political and economic risks of host country

✗ Navigating cultural differences with local workforce

According to the UN Conference on Trade and Development (UNCTAD), global FDI flows have not yet recovered to pre-pandemic levels, as firms grapple with economic uncertainty and rising interest rates.[12]

7- Wholly Owned Subsidiary

A wholly owned subsidiary is a special case of FDI, in which the parent company fully owns and controls the foreign operation.

Examples:

- Tech giants like Google and Microsoft have established R&D centers and sales offices in dozens of countries as wholly owned subsidiaries.

- Luxury conglomerate LVMH owns brands like Louis Vuitton and Bulgari and operates a network of wholly owned retail subsidiaries in major cities worldwide.[13]

Advantages:

✓ Complete control over strategy and operations

✓ Secure intellectual property and business practices

✓ Capture full financial upside

Disadvantages:

✗ High capital investment and startup costs

✗ Need to build local teams and infrastructure

✗ Financial risk is not shared with partners

Boston Consulting Group senior partner Nikolaus Lang notes: “Wholly owned subsidiaries offer the tightest coordination and control, but also require the deepest local knowledge and financial commitment.”[14]

Key Questions for Navigating International Business

With those seven types of international business in mind, here are some key questions to consider:

- What are our core competitive advantages and how can we best leverage them in foreign markets?

- Which countries or regions offer the most attractive market potential and growth rates for our products/services?

- How do we navigate differences in consumer preferences, regulations, and business norms in each target market?

- What is the right balance between standardization and localization of our products and marketing?

- Which mode of market entry (exporting, FDI, JV, etc.) aligns best with our strategy and risk tolerance?

- How do we build an effective global organization and culture while respecting local practices?

- What is the optimal global supply chain and production footprint to balance cost, speed, and resilience?

- How can we protect our intellectual property as we expand into foreign markets?

- What partnerships or alliances can provide complementary capabilities and risk sharing?

- How do we allocate capital and talent across our global portfolio over time based on performance and potential?

For further insights on the strategic and human aspects of competing globally, I highly recommend the following video:

- Pankaj Ghemawat: “Actually, the world isn’t flat” (TED, 16:40) https://www.youtube.com/watch?v=KPNn880KWfU

Closing Thoughts

We’ve covered a lot of ground in this guide to the seven types of international business. As we’ve seen, each mode of foreign market entry involves distinct tradeoffs and risks.

Ultimately, creating a successful global strategy comes down to clearly defining your value proposition, rigorously prioritizing markets, and adapting smartly to local contexts. It’s a complex undertaking, but the rewards of getting it right – in terms of growth, diversification, and innovation – are immense.

The most admired global companies develop a nuanced understanding of the similarities and differences among countries, and evolve their approaches over time as markets and competitors change. They combine a clear strategic vision with on-the-ground savvy and flexibility. By working through the tough questions outlined above, you’ll be well on your way to finding your winning global path.

FAQ: International Business

- What are the main advantages and disadvantages of exporting compared to other modes of international business?

A: The main advantages of exporting are that it’s a relatively simple way to enter foreign markets, carries lower risk than setting up overseas operations, and can benefit from positive “country of origin” perceptions. The disadvantages include transportation costs, potential tariffs, less control over foreign marketing and distribution, and exposure to shipping delays or disruptions.

- How does licensing differ from franchising in international business?

A: While both licensing and franchising involve granting rights to foreign partners, franchising goes a step further. With licensing, the licensor typically only provides the right to use its intellectual property (brand, design, technology, etc.). In franchising, the franchisor provides the entire business model and system, including ongoing support and guidelines for how to operate the business.

- What are the key factors to consider when evaluating international joint venture opportunities?

A: Evaluating a potential joint venture involves both strategic and operational considerations. Key factors include: alignment of the partners’ goals and metrics for success, complementary strengths and resources, agreement on ownership structure and management control, analysis of financial and political risks, and a clear plan for dispute resolution and potential termination of the JV.

- What are the main challenges of managing wholly-owned subsidiaries in foreign markets?

A: Operating wholly-owned subsidiaries abroad poses several challenges. These include the high cost of capital investment, building local awareness and distribution from scratch, and navigating differences in regulations across markets. Because the parent company bears all of the risk, it’s critical to understand the market dynamics and competitive landscape in each country.

- How do companies decide which markets to prioritize for international expansion?

A: Prioritizing international markets typically involves both quantitative analysis (e.g. market size, growth rate, profitability) and qualitative assessment (e.g. competitive intensity, political stability, cultural “fit”). Many firms use a weighted scoring model across multiple factors to rank opportunities. Ultimately, the most attractive markets should have a good balance of potential reward and manageable risk.

- What are some of the key reasons that companies’ international expansion efforts fail?

A: Some of the most common pitfalls in international expansion include: failing to adapt products or marketing to local preferences, underestimating the costs and time required to establish foreign operations, not building strong local teams and partnerships, spreading resources too thinly across too many markets, and being ill-prepared to respond to competitive or regulatory changes.

- How can companies protect their intellectual property when doing business internationally?

A: Safeguarding IP requires a multi-pronged approach. Key steps include: registering trademarks and patents in each relevant country, carefully screening potential partners’ track records and reputations, building strong contractual protections into licensing and JV agreements, training employees on confidentiality procedures, investing in cybersecurity measures, and actively monitoring markets for potential infringements.

- What are some effective strategies for building global brands?

A: Building strong global brands is both an art and a science. Core principles include: having a clear, purposeful brand positioning, establishing consistent visual and messaging identity across touchpoints, understanding category and cultural nuances in key markets, balancing global consistency with locally relevant activations, and focusing on the most iconic brand assets that can be scaled across markets.

- How are supply chains and international business strategies evolving in the wake of the COVID-19 pandemic?

A: The pandemic has accelerated several shifts in global supply chains. These include: greater emphasis on resilience vs. pure cost efficiency, increased investment in digital tools for real-time visibility, more nearshoring and multi-sourcing to reduce risk, and heightened scrutiny on the sustainability and social responsibility practices of suppliers. At a strategic level, some firms are reassessing the complexity of their global footprints.

- What skills and mindsets are most important for leaders and managers working in international business?

A: Effective global leaders need a unique combination of hard and soft skills. These include: deep cross-cultural competence, curiosity and open-mindedness, cognitive flexibility to navigate complexity, emotional intelligence to build trust and rapport, strong communication skills across contexts, systems thinking to connect dots across silos, and strategic agility to balance short and long term priorities. At the core, a global mindset means the ability to bridge differences and find common ground.

[2] https://www.macrotrends.net/stocks/charts/BA/boeing/revenue [3] https://insight.kellogg.northwestern.edu/article/the-perils-of-international-business [4] https://www.supplychainbrain.com/articles/37065-a-decade-after-rana-plaza-are-retailers-supply-chains-any-safer [6] https://hbswk.hbs.edu/item/licensing-a-powerful-way-to-get-your-product-to-global-markets [8] https://www.wsj.com/articles/tesla-goes-it-alone-in-china-for-better-and-worse-70eea96b [9] https://knowledge.wharton.upenn.edu/article/why-joint-ventures-fail-and-how-to-prevent-it/ [10] https://www.reuters.com/technology/apple-supplier-foxconn-wins-airpod-order-plans-200-mln-factory-india-2023-03-16/ [11] https://www.selectusa.gov/FDI-in-the-US [12] https://unctad.org/news/global-foreign-direct-investment-recovered-pre-pandemic-levels-2021-uncertainty-looms [13] https://www.wsj.com/articles/lvmh-has-a-plan-to-deal-with-a-global-recession-it-used-it-during-the-pandemic-11603452838