What are the 4 types of tariffs? A simple example of a tariff definition is a tax imposed by a government on goods brought into the country from another place. For instance, imagine a country places a 10% tariff on imported toys. If a toy company from another country sells a toy for $20, once it arrives in the importing country, a $2 (10% of $20) tariff is added to its cost.

This makes the imported toy more expensive for local stores and, eventually, for consumers compared to toys made within the country.

Eliminate compliance risks and penalties before they impact your bottom line. Our AI platform continuously monitors global trade regulations to keep your business protected. We’ve helped companies reduce compliance processing time by up to 75% while maintaining 99.8% accuracy. Start your free trade assessment now and see the difference true compliance confidence makes.

What is a Tariff?

What are tariffs? A tariff is simply a tax that governments place on goods coming into their country from abroad. Think of it as an entry fee that imported products must pay at the border before they can be sold in the local market. All of this, brings you to this question: “What are customs duties and tariffs?”

Tariffs create a price difference between foreign and local products, giving domestic manufacturers a home-field advantage while potentially raising costs for shoppers at the checkout counter. Before anything else, you need to find the answer to

What Are the 4 Types of Tariffs?

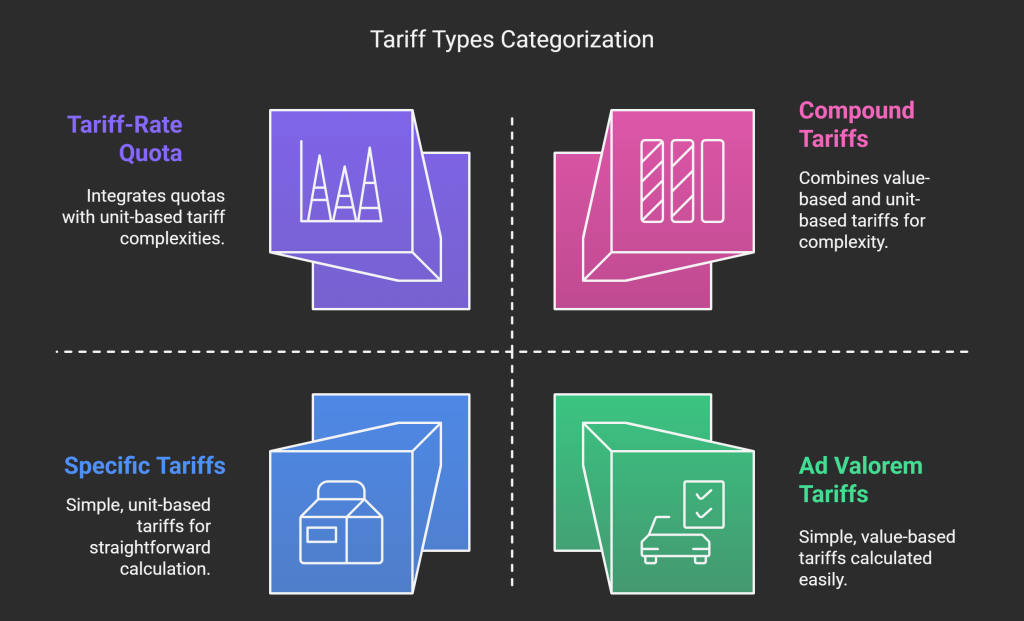

When countries implement tariffs, they don’t follow a one-size-fits-all approach. Instead, governments employ various tariff structures to achieve specific economic and trade objectives. Each type has its unique calculation method and impact on imported goods. Generally, the most common type of tariff is an ad valorem tariff.

What are the 4 types of tariffs? Here, you can simply find the answer to your question “What is tariff and types of tariffs with example.”

| Tariff Type | Definition | Examples |

| Ad Valorem Tariffs | Calculated as a percentage of the imported good’s value | • 15% tariff on a $40,000 imported vehicle adds $6,000, making the total cost $46,000• 10% tariff on imported motor vehicles worth $10,000 results in a $1,000 tariff |

| Specific Tariffs | Fixed fees imposed on each unit of an imported good, regardless of its value | • $0.23 tariff per pound of imported fish• $15 tariff on each pair of imported shoes• 3.2 cents per liter on certain imported milk products |

| Compound Tariffs | Combine ad valorem and specific approaches, applying whichever generates more revenue | • Tariff on chocolate calculated as either $2 per pound OR 17% of its value, with customs applying the higher amount |

| Tariff-Rate Quotas | Two-tier system where a lower tariff applies up to a certain quantity threshold, after which a higher tariff kicks in | • 10% tariff on the first 1,000 units imported, with a 30% tariff on any units beyond that limit |

Are Tariffs and Import Quotas the Same?

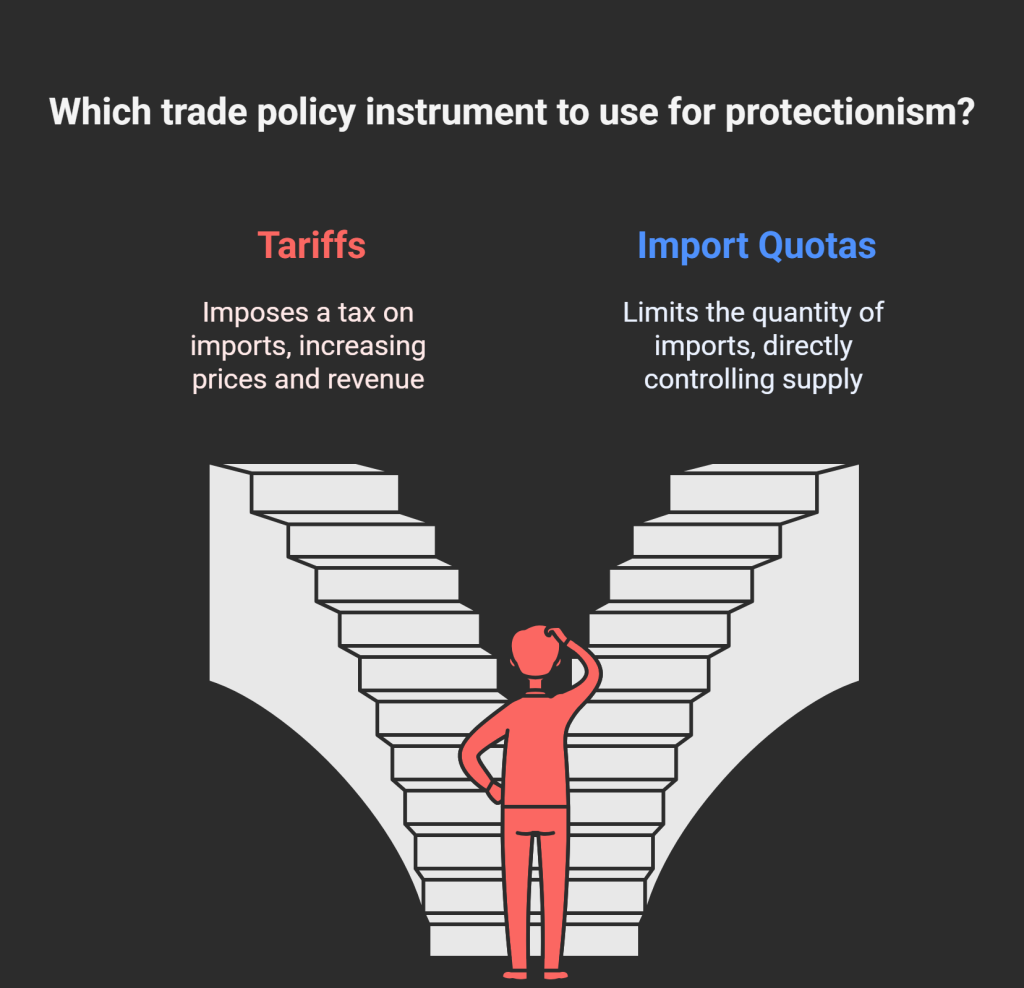

When governments want to protect their domestic markets, they often turn to two powerful trade policy instruments: tariffs and import quotas. While both serve similar purposes, they operate through different mechanisms and create distinct economic impacts.

Both tariffs and import quotas function as protective barriers in international trade, aiming to shield domestic industries from foreign competition. They share several key similarities:

- Both are forms of protectionism designed to limit foreign goods in domestic markets.

- Both effectively reduce import quantities, though through different means.

- Both typically increase domestic prices for the targeted goods.

- Both tend to boost domestic production by limiting foreign competition.

However, these trade barriers differ significantly in their implementation and effects:

Tariffs: The Tax-Based Approach

A tariff is essentially a tax imposed on imported goods. When products cross the border, importers must pay this tax before the goods can enter the domestic market. The cost of this tax is typically passed on to consumers through higher prices.

Import Quotas: The Quantity Restriction

In contrast, an import quota directly limits the physical quantity of a particular good that can be imported during a specific period. Once the quota is reached, no additional imports are permitted, regardless of market demand.

Who Pays Tariffs and Who Benefits from Them?

Here’s a bitter truth! while importers technically pay tariffs directly to customs authorities, the economic burden primarily falls on:

- Consumers: Through higher prices for both imported and sometimes even domestic goods

- Importers: Who may absorb some tariff costs to remain competitive

- Foreign exporters: Who might face reduced demand for their products

On the other hand, several groups stand to gain from tariff policies:

- Governments: Collect revenue directly from tariff payments

- Domestic producers: Face less price competition from imports, potentially allowing them to charge higher prices

- Workers in protected industries: May enjoy greater job security and possibly higher wages

- Developing industries: Gain time to grow and become competitive without being overwhelmed by established foreign competitors

- Strategic sectors: Industries deemed vital for national security receive protection from foreign dependence

FAQ

1- which type of tariff is the most common one? The most common type of tariff is the Ad Valorem tariff, which will be calculated as a percentage of the imported good’s value.

2- What are “nuisance tariffs”? Very low tariff rates (typically under 2-3%) that generate minimal revenue and protection but create administrative burdens. They persist due to historical inertia and as potential bargaining chips.

3- What are digital service taxes (DSTs)? Special taxes on revenues from digital services within a country, functioning similarly to tariffs for digital trade by imposing costs specifically on foreign digital providers.

4- How do environmental tariffs differ from standard tariffs? They specifically address environmental concerns rather than economic protectionism, targeting imports produced with lower environmental standards.

5- What are sliding scale tariffs? Tariffs that automatically adjust based on market conditions—typically increasing when world prices fall and decreasing when they rise—to maintain stable domestic prices.

6- How do transit tariffs differ from import tariffs? Transit tariffs apply to goods merely passing through a country en route elsewhere, while import tariffs apply to goods entering a country’s domestic market.

7- What’s the difference between bound and applied tariff rates? Bound rates are maximum rates a country commits not to exceed in WTO agreements. Applied rates are what’s actually charged, which can be lower but not higher than bound rates.

8- What are prohibitive tariffs? Extremely high tariffs (often exceeding 100%) designed to completely block imports by making them commercially unviable.

9- How do seasonal tariffs function? Higher duties applied to agricultural imports during domestic harvest seasons, then lowered during off-seasons. They protect local farmers when domestic production peaks.

10- What are preferential tariffs? Reduced rates applied to imports from countries with trade agreements. They create tiered systems where partner nations pay lower rates than others.

11- How can I tell if price increases are due to tariffs? Look for similar increases across multiple brands, explicit mentions by sellers, timing that coincides with tariff implementation, and larger increases on products from specific countries.

12- How do carbon border adjustment tariffs work? They tax carbon-intensive imports from countries with weaker climate policies to prevent “carbon leakage” and protect domestic industries paying carbon taxes.

13- What was the impact of the US-China tariff war? American consumers bore most costs, manufacturing jobs didn’t significantly increase, agricultural exports suffered, and some production shifted to other countries rather than returning to the US.

14- What was the Smoot-Hawley Tariff Act? A 1930 law that dramatically raised US tariffs, triggered retaliatory tariffs, collapsed global trade, and worsened the Great Depression.

15- How do tariff exemptions work? Companies can apply for exemptions by proving the tariffed good isn’t available domestically, causes severe economic harm, or affects national security.

16- What are “safeguard tariffs”? Temporary measures providing domestic industries time to adjust to sudden import surges, without requiring proof of unfair trade practices.

17- What are countervailing duties and anti-dumping tariffs? Countervailing duties target subsidized imports; anti-dumping tariffs target goods sold below fair market value. Both address unfair trade practices.

18- How do retaliatory tariffs work? When one country imposes tariffs, affected countries respond with their own tariffs, typically targeting politically sensitive industries to create maximum pressure.