What are customs duties and tariffs? While these terms are sometimes used interchangeably, they serve distinct purposes and operate through different mechanisms. Have you ever wondered why imported products sometimes cost more than their domestic counterparts? The answer often lies in tariffs and duties—two critical tools governments use to regulate international trade.

What is custom tariff? Tariffs are government-imposed taxes specifically targeting imported goods, while customs duties are broader category of indirect taxes levied on goods crossing international borders.

Reduce risk and increase certainty in your global supply chain with technology built specifically for international trade professionals. Our platform provides real-time guidance on changing regulations affecting your specific products and markets. We understand that compliance isn’t just about avoiding penalties—it’s about creating predictable, efficient operations. Schedule your platform walkthrough and see the future of compliant trade.

What Is Custom Tariff?

Tariffs are direct taxes imposed by governments on goods moving across international borders. Think of them as a government’s way of saying, “If you want to sell your foreign products in our market, you’ll need to pay this fee.”

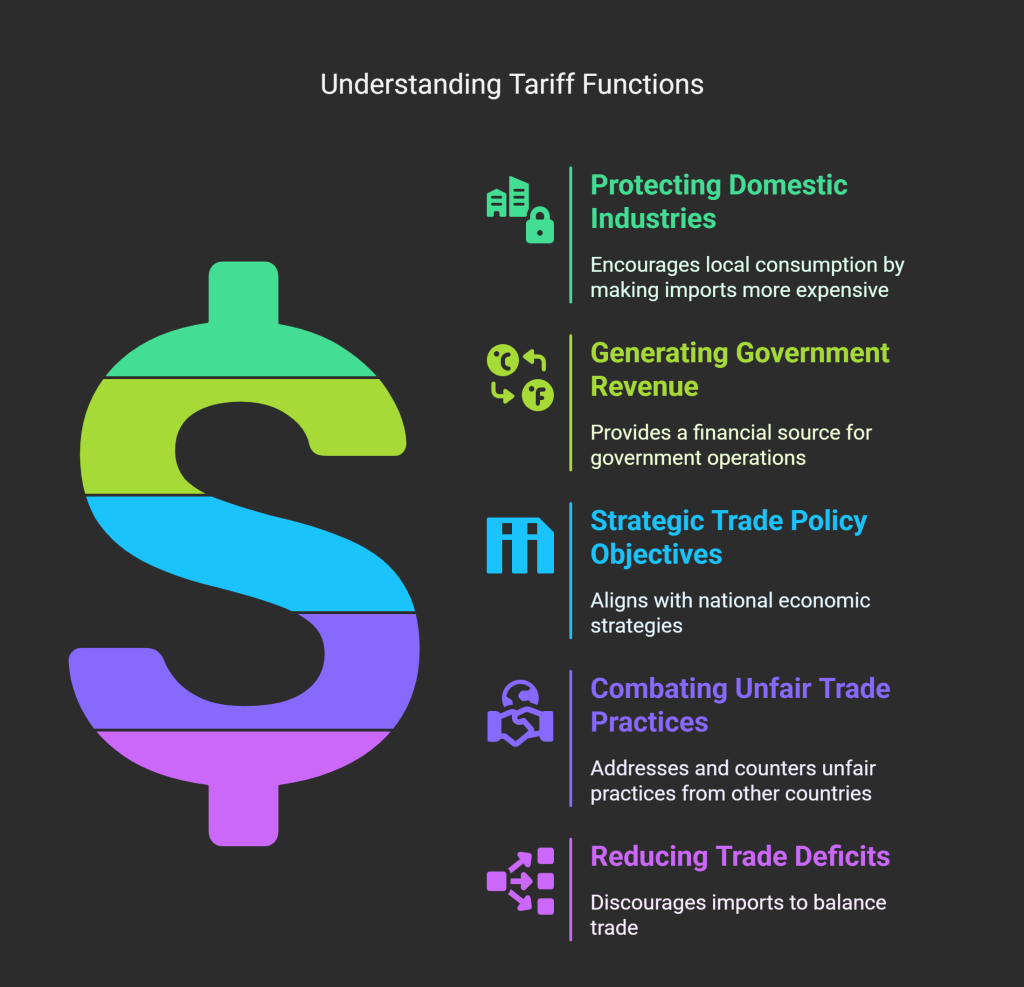

Tariffs primarily aim to protect domestic industries by making imported goods more expensive, which encourages consumers to buy locally produced alternatives. This protection can help preserve jobs, boost local economies, and maintain industrial capacity within a country.

But tariffs serve other important purposes too:

- Generating revenue for the government

- Achieving strategic trade policy objectives

- Combating unfair trade practices by other countries

- Reducing trade deficits by discouraging imports

When you purchase an imported product, you might not see the tariff listed separately on your receipt, but it’s often baked into the final price you pay.

What Are Different Types of Tariffs?

Tariffs typically come in two forms:

- Specific tariffs: Fixed amounts charged per unit of imported goods. For example, $5 per barrel of oil or $2 per pair of shoes.

- Ad valorem tariffs: Calculated as a percentage of the total value of the imported shipment. For instance, a 10% tariff on a $1,000 shipment of electronics would add $100 to the cost.

What Are Customs Duties?

While tariffs focus specifically on international trade protection, duties encompass a wider range of taxes related to the movement of goods. Customs duties are the most common type, charged when goods across international borders.

The primary goal of customs duties is to raise revenue for the government, though they also offer some protection to domestic industries by making imports more expensive. What sets them apart is that importers pay these taxes directly to customs authorities when goods enter the country.

What Are Different Types of Duties?

Unlike tariffs, which focus solely on international trade, some duties (like excise duties) can apply to both domestic and imported goods. These “sin taxes” on products like cigarettes, alcohol, and gambling services are designed to discourage consumption of potentially harmful products while generating revenue.

| Type of Duty | Explanation |

| Customs Duty | An indirect tax on imported (and sometimes exported) goods, levied on value, weight, or dimensions. Paid by importers at the time of import and often passed on to consumers. |

| Basic Duty | A primary form of customs duty that serves as the standard import tax rate. |

| Additional Customs Duty | Supplementary duty charged on top of the basic customs duty, often for specific policy reasons. |

| Countervailing Duty | Import tax imposed on goods that have received subsidies from foreign governments, designed to level the playing field for domestic producers. Also known as anti-subsidy duty. |

| Anti-dumping Duty | Applied to imports priced unfairly below market value (“dumping”), protecting domestic industries from predatory pricing. |

| Safeguard Duty | Temporary measures to protect domestic industries from sudden surges in imports that might cause serious injury. |

| Excise Duty | Applied to specific goods—often those considered harmful like tobacco and alcohol or products causing pollution—regardless of whether they’re domestically produced or imported. |

What Are Customs Duties and Tariffs?

Now that we understand both concepts individually, let’s compare them directly:

| Feature | Tariffs | Customs Duties |

| Definition | Direct taxes on imports or exports | Indirect taxes on goods crossing borders |

| Primary Purpose | Protect domestic industries from foreign competition | Generate government revenue |

| Secondary Purposes | Trade policy objectives, combating unfair trade | Some protection of domestic industries |

| Who Pays | Reflected in higher prices for consumers | Paid by importers at time of entry, then passed to consumers |

| Flexibility | Can be strategically adjusted for trade objectives | May have exemptions through trade agreements |

| Types | Specific (fixed amount) or ad valorem (percentage-based) | Multiple types including basic, additional, countervailing, anti-dumping |

| Application | Only on imports and exports | Some duties (like excise) apply to domestic goods too |

When you buy that imported bottle of wine or that foreign-made smartphone, you’re experiencing the effects of these trade policies firsthand. The price you pay reflects a complex web of tariffs and duties that governments have strategically implemented.

For businesses, navigating these taxes requires careful planning. Companies often factor these costs into their supply chain decisions—sometimes opting to manufacture in certain countries to avoid high tariffs or duties in their target markets.

FAQ

1- What’s the difference between customs duties and tariffs?

There’s actually no difference. The terms “customs duties” and “tariffs” are used interchangeably to refer to taxes imposed on imported goods. These are typically calculated as a percentage of the item’s value but can sometimes be a fixed amount per unit.

2- How do I know if I need to pay customs duties when ordering from overseas?

Most countries have a minimum threshold value (de minimis) below which no duties are charged. In the US, it’s $800 for most personal imports. The UK has a £135 threshold, while the EU generally sets it at €150. Anything above these values typically incurs duties, though rates vary by product category and country of origin.

3- Why do some packages from overseas get charged duties while others don’t?

This seeming inconsistency happens for several reasons: some packages may fall under the duty-free threshold, certain carriers have different processes for collecting duties, some sellers might pre-pay duties (DDP – Delivered Duty Paid), or customs officials simply can’t inspect every package entering the country, so some pass through without assessment.

4- Can I avoid paying customs duties legally?

Yes, there are legal ways to minimize duties: stay under your country’s de minimis threshold with smaller orders, purchase from countries with free trade agreements with your country, use duty-free allowances when traveling, or take advantage of certain duty exemption programs for specific types of goods or purposes (like educational materials).

5- Who calculates and collects customs duties?

Customs duties are calculated and collected by your country’s customs authority (e.g., U.S. Customs and Border Protection, HM Revenue & Customs in the UK). However, shipping companies and postal services often act as collection agents, charging you the duty amount plus a handling fee when delivering your package.

6- Are customs duties the same as import VAT/sales tax?

No. While both are collected at the border, they’re different taxes. Customs duties are taxes specifically on imported goods, while import VAT (Value Added Tax) or sales tax is the same consumption tax you would pay on domestic purchases. In most countries, you’ll pay both when importing items above the threshold.

7- How are customs duties calculated?

Duties are typically calculated as a percentage of the customs value (cost of goods + shipping + insurance). The percentage varies widely based on the type of product and country of origin, ranging from 0% to over 100% for certain items. Some products may have fixed-rate duties based on quantity or weight instead of value.

8- What is the Harmonized Tariff Schedule (HTS)?

The Harmonized Tariff Schedule is a standardized numerical classification system for traded products. Each product category is assigned a specific 6-10 digit HTS code, which determines its duty rate. The first six digits are internationally standardized, while additional digits are country-specific.

9- Can I dispute customs charges if I think they’re incorrect?

Yes. If you believe duties were incorrectly assessed, you can file a protest or appeal with your country’s customs authority. You’ll need documentation proving the item’s actual value, origin, or classification. Most countries have a specific timeframe for filing disputes (often 90-180 days from payment).

10- Do customs duties apply to gifts I receive from overseas?

Most countries offer some duty exemption for gifts, but there are limits. In the US, gifts valued under $100 are duty-free. The EU typically allows gifts under €45 to enter duty-free. These exemptions often don’t apply if the sender marks the package as a gift but it’s actually a commercial transaction.

11- What happens if I refuse to pay customs duties?

If you refuse to pay, the package will typically be returned to the sender or, in some cases, abandoned to customs. The carrier may charge return shipping fees to the sender. Repeatedly refusing to pay duties won’t result in legal consequences, but it will mean you don’t receive your items.

12- What are preferential tariff rates?

Preferential tariff rates are reduced duty rates applied to goods imported from countries with which your country has free trade agreements. For example, under the USMCA (formerly NAFTA), many goods can move duty-free between the US, Mexico, and Canada if they meet specific origin requirements.

13- Why do some countries charge such high import duties?

High import duties serve multiple purposes: protecting domestic industries from foreign competition, generating revenue for the government, discouraging consumption of certain goods (like luxury items or those with environmental impacts), and sometimes as retaliatory measures in trade disputes.

14- How do tariffs affect product prices for consumers?

Tariffs typically increase end-product prices, as businesses usually pass these costs onto consumers. A 10% tariff doesn’t necessarily mean a 10% price increase, however, as companies might absorb some costs, find alternative suppliers, or adjust their supply chains to minimize the impact.

15- What’s the difference between duties and customs processing fees?

Besides duties, most countries charge separate customs processing fees. In the US, this is called the Merchandise Processing Fee (MPF), which is 0.3464% of the item’s value (minimum $27.23, maximum $538.40 for commercial imports). These administrative fees apply even to duty-free goods.

18- Can I get a refund on duties if I return an item to the overseas seller?

Yes, most countries offer duty drawback or refund programs if imported goods are returned unused. You’ll need to file specific paperwork with your customs authority and provide evidence of the return. The process can be bureaucratic and time-consuming, so for smaller amounts, it might not be worth the effort.