What are the import duties? When you buy products from other countries, your government typically collects taxes called import duties. These kick in the moment those foreign goods arrive at your borders or when they’re cleared for use in your country. How much will you pay? Import duties are usually calculated based on your goods’ value, which often includes not just the product cost but also shipping and insurance (what professionals call the “CIF value” or “border value”).

Protect your business from unexpected compliance penalties that can devastate your profits. Our AI platform identifies potential issues before they become costly problems, giving you peace of mind with every shipment. We’ve built our reputation by solving real compliance challenges for businesses just like yours. Book a consultation with our trade experts and secure your international operations.

What Are the Import Duties?

What is the import duty? Let me walk you through import duty in a way that makes sense for your business. import duties are part of the customs duties. What are customs duties and tariffs? Well, that’s something you should definitely know about!

Think of import duty as a tax you pay when bringing goods into a country from overseas. It’s like a toll gate for international products entering your local market.

When you import those amazing products you’ve sourced from abroad, customs authorities will collect this tax right as your goods enter the country. And just so you know, people sometimes call it customs duty, tariff, import tax, or import tariff—all referring to the same thing.

Here’s how it works for you: The government calculates import duty based on your product’s value, including what you paid for the items, shipping costs, and insurance. They’ll look at your product’s Harmonized System code (that classification number) and where it came from to determine your rate. Any trade agreements between countries might give you a better rate, which is always nice!

Why do you face these charges? Governments have several reasons:

- They need the revenue (governments love their revenue streams!)

- They’re trying to give local businesses like yours an advantage when you produce domestically

- They regulate potentially harmful products like cigarettes

- Sometimes they’re making a political statement by charging higher duties on specific countries

Here’s something important for your budgeting: Unlike VAT, you can’t reclaim import duty during normal business operations. Then, when you’re calculating your costs and setting your prices, make sure to factor in these duties—they’re a real cost of doing business internationally.

Does this impact any current imports you’re handling? I’m happy to dive deeper into any specific aspects that would be most helpful for your situation!

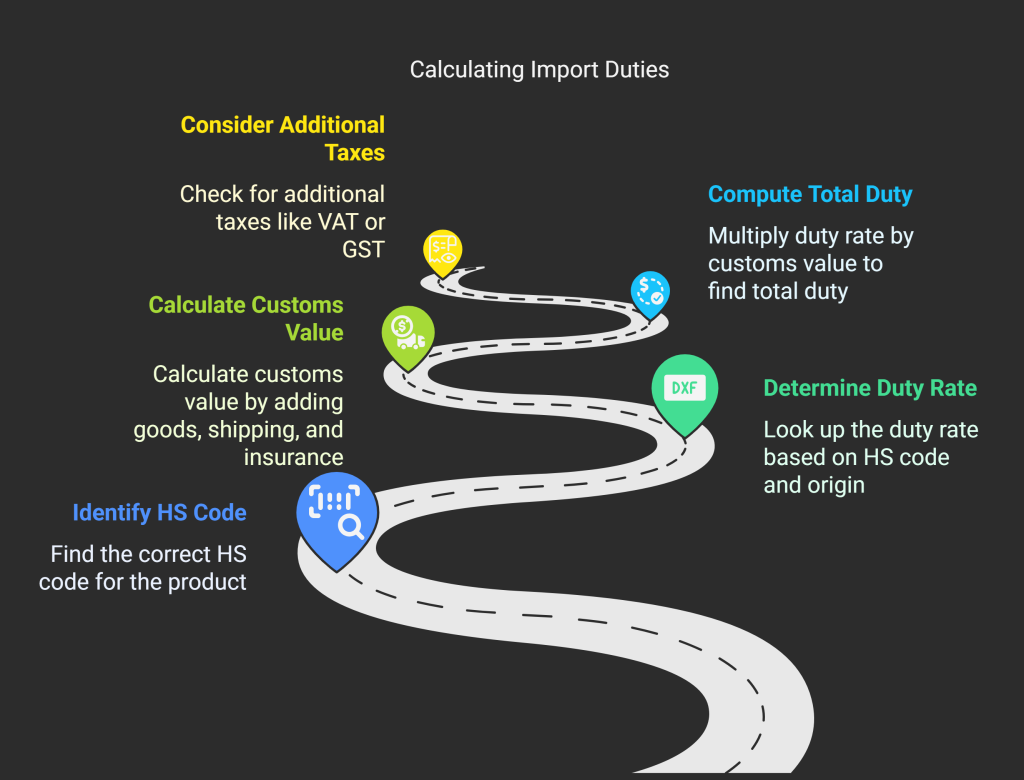

How to Calculate Import Duties with Examples

Calculating import duties requires attention to detail and knowledge of the specific codes and rates for your products. Follow these steps to accurately determine what you’ll owe:

1- Step One: Finding the Correct HS Code

Find the correct HS Code for your product. This universal classification system helps customs authorities worldwide identify your goods. For example, leather handbags use code 42221. Over 200 countries use this universal classification system to categorize goods.

2- Step Two: Look Up the Duty Rate

Then, you need to look up the duty rate for your product based on its HS code and country of origin. Trade agreements between countries often affect these rates. For example, if the duty rate for leather handbags is 5%, you would definitely need to use this rate in your calculations.

3- Step Three: Calculate the Customs Value

Calculate the customs value by adding the price of your goods plus shipping and insurance costs. For instance, if you bought handbags for $10,000, paid $1,000 for shipping, and $200 for insurance, your customs value equals $11,200.

4- Step Four: Final Calculations

Multiply the duty rate by the customs value to determine your total duty. With a 5% duty rate on an $11,200 customs value, you’ll pay $560 in import duties.

do not forget that different types of duties might also apply to your imports:

- Ad Valorem Duties: Percentage-based duties calculated on the value of goods

- Specific Duties: Fixed amounts charged per unit (like $0.50 per kilogram)

- Mixed or Compound Duties: Combinations of both percentage and fixed-amount duties

Remember that you might need to pay additional taxes like VAT or GST on top of import duties, depending on the country’s regulations.

For the most accurate calculations, check official government customs websites or consult with customs brokers who can guide you through the specific requirements for your situation.

Who Pays Import Duties?

Let’s talk about import duties and who’s actually responsible for paying them – it’s simpler than you might think!

You’ll typically find that the “importer of record” pays the import duties. This could be you as an individual or your business if you’re bringing goods into a country.

When you buy something internationally, your sales agreement with the seller should clearly spell out who’s responsible. Look for terms like DDP (Delivered Duty Paid) where the seller handles the duties, or DDU (Delivered Duty Unpaid) where you’ll need to cover them.

Three main parties might end up paying import duties:

- You as the product owner

- You as the purchaser

- A customs broker you’ve hired

If you’re running an ecommerce business, I’d strongly recommend hiring an Importer of Record (IOR). These experts will manage everything related to customs for you! They’ll determine which duties apply to your specific products, handle all payments, and solve any problems if your shipments get stuck in customs.

Working with an IOR helps you avoid headaches like penalties or legal issues from incorrect classifications. While this service adds to your costs, you’ll ultimately factor these expenses into your product pricing anyway.

Documentation You Need for Import Duty Payment

Here is exactly what paperwork you’ll need when paying import duties – I’ll make this super clear for you!

1- Commercial Invoice

First, you’ll definitely need a commercial invoice. This document shows all the important details about your transaction with the seller, including the value of your goods and sale terms. Customs officials will use this to figure out exactly how much duty you owe based on what you’ve declared.

2- Bill of Lading/Airway Bill

For shipping proof, you’ll need either a bill of lading (for ocean shipments) or an airway bill (for air shipments). Think of this as your official receipt that shows who sent the goods, who’s receiving them, what’s being shipped, and the route they’re taking. This helps customs verify that everything is legitimate.

3- Packing List

Don’t forget your packing list! This detailed breakdown shows the quantity, weight, and dimensions of everything you’re importing. Customs officials will compare this with your physical shipment to make sure everything matches what you declared.

4- Certificate of Origin

You’ll also need a certificate of origin that proves where your goods were manufactured. This can actually save you money if your goods come from a country with favorable trade agreements!

5- Permits or Licenses

Depending on what you’re importing, you might need special permits or licenses for restricted or regulated items. Always check these requirements before shipping.

6- Customs Entry Form

The official declaration form you’ll submit when importing goods.

7- Proof of Insurance

This one shows your shipment is properly insured during transit.

8- Payment Receipt

Finally, always remember to keep documentation of all duty payments that you made.

All these documents help customs classify your goods under the proper Harmonized System (HS) code, determine your duty rate, and ensure you’re following all import regulations.

FAQ

1- What are import duties? Import duties are taxes imposed by governments on goods brought into a country from abroad. They’re designed to protect domestic industries and generate revenue.

2- How are import duties calculated? Import duties are typically calculated as a percentage of the declared value of the goods. The percentage varies by product category, country of origin, and destination country.

3- Do I have to pay import duties on gifts I receive from abroad? Most countries have a value threshold for gifts below which no duties are applied. However, if the gift exceeds this threshold, you’ll typically need to pay import duties.

4- What’s the difference between import duties, taxes, and customs fees? Import duties are specific taxes on imported goods. Sales taxes (like VAT) are general consumption taxes. Customs fees cover administrative processing and inspection costs.

5- Can I avoid paying import duties legally? You can’t avoid duties entirely, but you can reduce them by purchasing goods below your country’s duty-free threshold, buying from countries with preferential trade agreements, or using duty suspension schemes for temporary imports.

6- Will I get charged import duties when ordering from Amazon/eBay/AliExpress? It depends on where the seller is located, the value of your purchase, and your country’s regulations. Many marketplaces now collect estimated import duties at checkout for international orders.

7- How do I know what the import duty will be before I order something? Many countries have online duty calculators. You can also check your country’s customs website for duty rates by product category or contact a customs broker for assistance.

8- Do I have to pay import duties on items I bring back from vacation? Most countries offer a personal exemption allowance for travelers, but if the value of your items exceeds this allowance, you may need to pay duties on the excess amount.

9- Who is responsible for paying import duties—the sender or the recipient? Typically, the recipient pays import duties. However, some shipping terms like DDP (Delivered Duty Paid) mean the sender covers these costs.

10- What happens if I refuse to pay import duties? If you refuse to pay, the package will usually be returned to the sender or potentially destroyed. You won’t receive your goods, and you might still be liable for return shipping costs.

11- Are there any exemptions from import duties? Yes, many countries offer exemptions for certain categories like educational materials, religious items, personal effects when moving internationally, humanitarian aid, and goods below a minimum threshold value.

12- How long does customs take to process my package and calculate duties? Processing times vary greatly by country, ranging from 1-2 days to several weeks, depending on staffing, volume, and whether your package requires special inspection.

13- What’s the difference between “de minimis” threshold and duty-free allowance? The de minimis threshold is the value below which imported goods are exempt from duties and taxes. A duty-free allowance typically refers to what travelers can bring back without paying duties.

14- Will I pay import duties on items I return to a foreign seller? You shouldn’t pay duties on returned items, but you’ll need to follow proper procedures. Many countries offer duty drawback programs where you can reclaim duties paid on returned goods.

15- Are import duties the same worldwide? No, import duties vary significantly between countries and can change based on trade agreements, product categories, and economic policies.

16- How do I declare items correctly to avoid duty problems? Always provide accurate descriptions, quantities, and values for your goods. Misrepresenting information to avoid duties is illegal and can result in fines, seizure of goods, or legal prosecution.

17- Can I get insurance to cover unexpected import duties? Some shipping companies and third-party insurers offer services that cover unexpected customs charges, though these are not common for personal imports.

18- Do electronics like smartphones and laptops have high import duties? It varies by country. Some nations impose high duties on electronics to protect domestic industries, while others keep duties low to promote technology adoption.

19- How do I pay import duties? Payment methods vary by country but typically include online payment portals, payment to the courier company delivering your package, or direct payment at customs offices.