What do tariffs do? Have you ever wondered why some imported products cost more than their domestic counterparts? The answer often lies in tariffs. Let’s explore what tariffs are and how they affect our everyday lives. A tariff is simply a tax that governments place on goods imported from other countries. Think of it as an extra fee that makes foreign products more expensive compared to those made at home.

When companies import products, they pay these taxes, and typically, they pass those costs on to us as consumers. Tariffs serve as a trade barrier and are commonly used as a protectionist measure to shield domestic industries.

Don’t let tariff complexity expose your business to unnecessary risks and penalties. Our cutting-edge AI platform delivers real-time tariff classification, duty calculation, and compliance verification to ensure your imports clear customs without delays or unexpected costs.

How Do Tariffs Work?

When a U.S. company imports goods from countries like Canada or Mexico, they must pay the tariff to the government. These costs don’t just disappear—they often show up in the prices we pay at checkout. Let me break down the different types of tariffs you might encounter:

| Type of Tariff | How It Works | Example |

| Ad valorem tariffs | Calculated as a percentage of the imported good’s value | A 25% tariff on a $10 t-shirt adds $2.50 to its cost |

| Specific tariffs | Fixed fee on each unit of an imported good | $15 per pair of imported shoes or $300 per imported computer |

| Tariff-rate quotas | Low rates for a certain quantity, then significantly higher once threshold is exceeded | First 1,000 tons of sugar might face a 5% tariff, with anything above that facing a 40% tariff |

Tariff Example; Real-World Impact of Tariffs

What are tariffs in Trade? Tariffs touch nearly every sector of our economy. For Example, when a U.S. company imports a good, for example, from Canada or Mexico, it becomes obligated to pay this tariff. According to CBS News business analyst Jill Schlesinger, what typically happens is that the importing company will pass along either the entire cost of this fee or a portion of it to the consumers. This means that the prices of imported goods tend to increase.

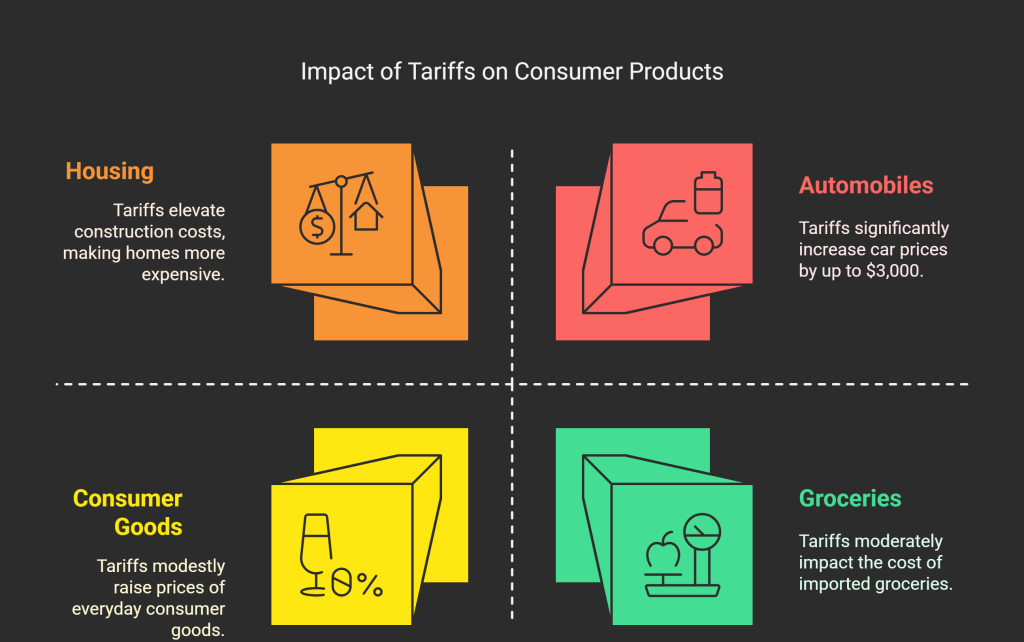

Let’s look at how they affect products you use every day:

- Housing: Since we import much of our lumber from Canada and Mexico, tariffs can drive up construction costs and ultimately make homes more expensive.

- Automobiles: Even “American-made” vehicles contain parts that cross borders multiple times during production. Tariffs can add thousands—potentially up to $3,000—to the price of a new car.

- Groceries: Those fresh fruits and vegetables from Mexico you enjoy? Tariffs can quickly increase their prices, affecting your grocery bill.

- Consumer goods: Even your favorite tequila for weekend margaritas becomes pricier when tariffs enter the picture.

Beyond individual product prices, tariffs can create ripple effects throughout the economy. In the short term, they often cause stock market volatility. Over time, they can push inflation higher and potentially slow economic growth by changing how we all spend our money.

The Pros and Cons of Tariffs

Like most economic policies, tariffs come with both advantages and disadvantages. Let’s look at both sides:

What Are the Advantages of Tariffs?

- Government revenue: Tariffs generate money for the government. In fact, during the 19th century, they provided more than half of the U.S. government’s income. Former President Donald Trump has argued that tariffs create “vast wealth for our country” and help pay down national debt.

- Protection for domestic industries and jobs: By making imports more expensive, tariffs can encourage consumers to buy domestically produced goods instead. This potentially keeps manufacturing jobs at home and strengthens supply chain resilience. Trump has stated that American workers no longer need to worry about losing their jobs to foreign nations because foreign nations will be worried about losing jobs to America.

- National interest leverage: Governments can use tariffs as diplomatic tools to influence other countries’ policies. For example, Trump used tariffs on Mexican and Canadian goods to pressure their governments on immigration and drug trafficking issues, and threatened tariffs to resolve a deadlock with Colombia over deported migrants.

Understanding tariffs helps you make sense of price changes you see in stores and economic news you hear. While they might seem like distant policy decisions, they directly impact your wallet and purchasing power. As we navigate an increasingly complex global economy together, being informed about these trade mechanisms helps us make better financial decisions and understand the forces shaping our economic landscape.

What Are the Downsides of Tariffs?

While tariffs may offer some benefits, they also come with significant drawbacks that affect you, me, and our entire economy. Let’s explore these challenges together:

- Higher Prices for Everyday Items: The most immediate impact you’ll likely feel is in your wallet. Studies from Trump’s first term showed that we, as American consumers, shouldered most of the economic burden from increased tariffs. When tariffs go up, so do prices on imported electronics, vehicles, and even your weekly groceries. As some economists have pointed out, tariffs essentially function as “a tax on consumers.”

- Opening the Door to Lobbying and Corruption: When tariffs become policy, they can create a system ripe for what economists call “cascading protectionism” and potential corruption. During the 2018-2019 China tariffs, we saw a complex web of exclusion requests and lobbying efforts emerge.

- Inviting Retaliation from Other Countries: When we impose tariffs on other nations’ goods, they rarely sit back and accept it. Instead, they typically respond with their own tariffs on our products. A 2024 study revealed that retaliatory levies imposed by China and other countries during Trump’s first administration had negative effects on American jobs, particularly hitting our farmers hard.

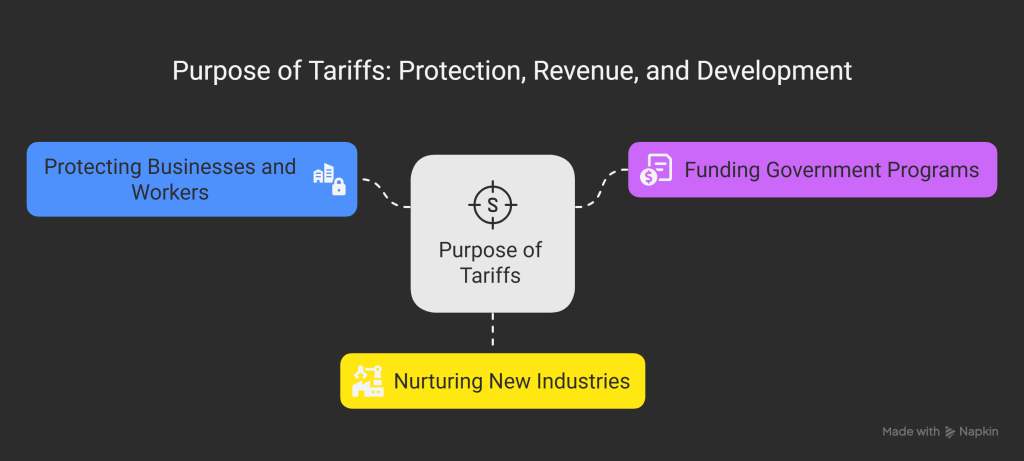

What Are Tariffs Used For?

Now that we understand the pros and cons, let’s explore why countries implement tariffs in the first place:

- Protecting Our Businesses and Workers

One of the primary reasons governments impose tariffs is to shield domestic industries from foreign competition. By making imported goods more expensive, tariffs aim to encourage us to buy products made at home, potentially saving jobs and businesses.

- Funding Government Programs

Did you know that tariffs serve as a significant revenue source for governments? Throughout most of the 19th century, tariffs provided more than half of the US government’s income.

- Nurturing New Industries

Just as parents protect their children while they grow, tariffs can shield young, developing industries from established foreign competitors. This “infant industry” protection gives new American businesses time to develop and become competitive on their own.

Turning Tariff Complexity into Competitive Advantage

In the high-stakes world of international business, tariff changes represent a significant compliance challenge that can directly impact your bottom line. The financial implications extend beyond the obvious price increases—they include potential customs penalties, supply chain disruptions, and administrative burdens that can drain resources and attention from your core business activities.

Your priority must be establishing robust compliance systems that not only ensure adherence to current regulations but can quickly adapt to policy changes. This means investing in trade compliance expertise, whether through in-house specialists or external partners with deep knowledge of tariff classification, country of origin requirements, and duty calculation. The cost of this investment pales in comparison to the potential penalties and business disruptions that can result from compliance failures.

FAQ

1- If tariffs are generally harmful, why do they remain politically popular?

Tariffs persist because their benefits are concentrated in specific industries and communities while costs are spread thinly across consumers. They appeal to national identity concerns, provide negotiating leverage, generate revenue, and create vested interests that lobby for continuation.

2- How do tariffs affect global supply chains?

Tariffs disrupt supply chains, leading companies to consider reshoring, nearshoring, diversification strategies, or supply chain segmentation. Complete reshoring remains rare due to costs and skill gaps.

3- Weren’t tariffs used successfully by countries like South Korea and Japan during development?

These countries did use strategic, selective, and temporary tariffs while simultaneously promoting exports, setting performance requirements, and investing in education and infrastructure. Their success depended on specific developmental contexts and strong state capacity. Most economists maintain that generally open trade policies deliver better outcomes for developed economies.

4- What’s the difference between tariffs and anti-dumping duties?

Answer: Tariffs apply broadly to product categories for economic or political reasons and can be imposed at a government’s discretion. Anti-dumping duties target specific companies selling below fair market value, require proof of injury to domestic industry, follow WTO rules, are typically temporary, and are considered trade remedies rather than protectionist measures.

5- Do tariffs actually bring manufacturing jobs back?

Results are mixed. While tariffs may create some jobs in protected sectors, these gains are typically offset by losses in industries using the now-more-expensive imports, export sectors facing retaliation, and reduced consumer spending. Companies often automate rather than hire or relocate to third countries instead of returning home.

6- How can small businesses manage tariff costs?

Small businesses can apply for exclusions, modify products to qualify for lower tariffs, use foreign trade zones, source from non-tariffed countries, review valuation methods, selectively pass through costs, stockpile inventory before tariffs take effect, and consult with trade experts for customized strategies.

7- How do tariffs affect the economy in the long run vs. short term?

Short-term, tariffs protect targeted industries and generate revenue. Long-term, they typically cause economic inefficiency, higher prices, job losses in export sectors, reduced innovation, trade partner retaliation, and supply chain disruptions. Most economists agree the overall economic impact is negative over time.

8- Why would a country impose tariffs if they make products more expensive?

Countries impose tariffs to protect domestic industries and jobs, generate revenue, address trade imbalances, respond to unfair trade practices, exert political pressure, and protect national security interests. While consumers face higher prices, governments weigh this against potential benefits in specific sectors.

9- Who actually pays for tariffs?

Despite political claims, tariffs are initially paid by importing companies in the country imposing them. These businesses then either absorb the cost, pass it to consumers through higher prices, or negotiate with suppliers. Research shows consumers and businesses typically bear most of the burden.