What is HTSUS? HTSUS stands for Harmonized Tariff Schedule of the United States Code. The HTS (Harmonized Tariff Schedule) code, or HTSUS code, is a system used to classify goods imported into the US and is based on the global HS code system. While the HS code is used in most countries, in the USA, you must use the HTS code to classify the duties rate for your product.

Have you ever wondered what happens when products across international borders? Let me introduce you to HTSUS – a critical system that governs how goods enter the United States. Whether you’re an importer, exporter, or simply curious about international trade, understanding HTSUS will help you navigate the complex world of customs and tariffs.

What Is HTS?

The Harmonized Tariff Schedule (HTS) forms the backbone of international trade classification. This powerful system identifies all internationally traded goods with specific codes. More than 170 countries worldwide use this system, making it truly global! The World Customs Organization (WCO) maintains these codes, ensuring consistency across borders.

HTS serves two critical functions:

- It identifies products moving between countries

- It provides the foundation for determining tariffs on imported goods

Getting your HTS code right matters enormously! Why? Because this code directly determines how much duty you’ll pay when importing products.

What is HTSUS?

The Harmonized Tariff Schedule of the United States (HTSUS) takes the global HTS system and customizes it specifically for the United States. Every single product entering the U.S. receives a ten-digit HTSUS code that determines its tariff classification.

What factors determine a product’s classification? It comes down to:

- The product’s name

- How the product gets used

- What materials make up the product

This comprehensive classification system serves as the backbone of U.S. import processes. Think of it as a massive catalog that categorizes every imaginable product that might enter the country. The HTSUS replaced the older Tariff Schedules of the United States (TSUS) on August 23, 1988, when the government implemented the Omnibus Trade and Competitiveness Act.

HTS vs. HTSUS: Understanding the Key Differences

Let’s break down the major differences between these two classification systems:

| Feature | HTS | HTSUS |

| Scope | Global (used by 170+ countries) | National (specific to United States) |

| Number of Digits | 6 digits (internationally harmonized) | 10 digits (first 6 match HTS + 4 U.S.-specific digits) |

| Primary Purpose | International product identification | Determining U.S. tariff classifications and duty rates |

| Maintenance Authority | World Customs Organization (WCO) | United States government |

| Update Frequency | Periodic global updates | Can include expiration dates for regular updates |

What Makes HTSUS So Important?

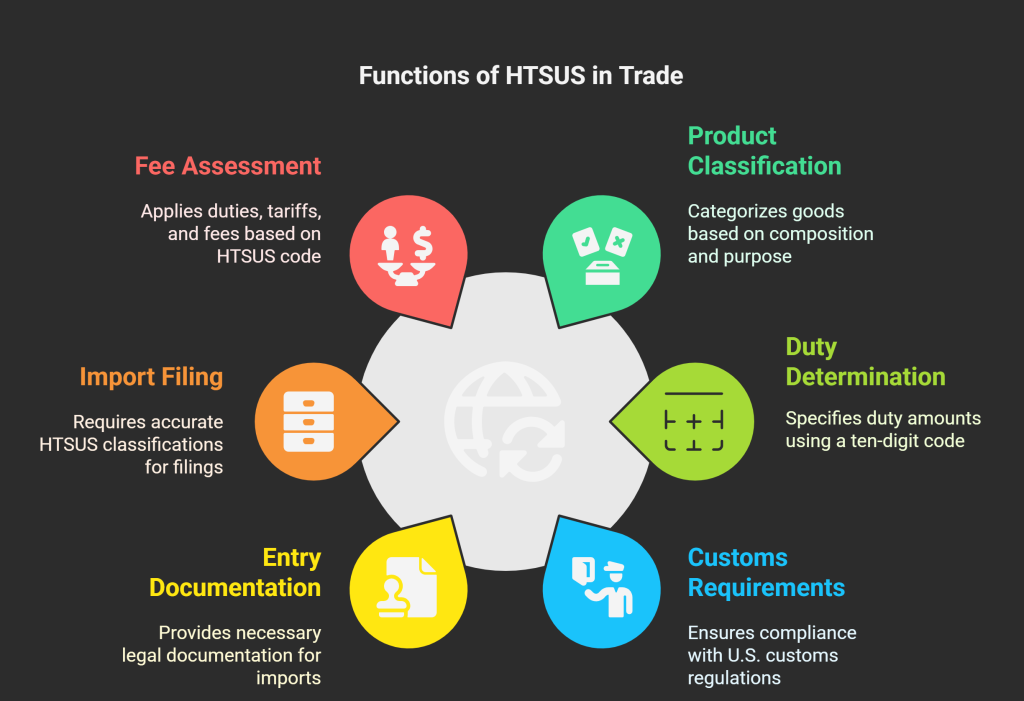

HTSUS performs several critical functions in international trade:

- Product Classification: It categorizes all goods entering the U.S. based on what they’re made of, what they’re called, and what they do

- Duty Determination: The ten-digit HTSUS code assigned to your product dictates exactly how much duty you’ll pay

- Customs Requirements: U.S. Customs and Border Protection (CBP) uses HTSUS to process all imports

- Entry Documentation: Every product needs a documented HTSUS code to legally enter the United States

- Import Filing: Importers must include correct HTSUS classifications on all import entries and security filings

- Fee Assessment: CBP applies import duties, anti-dumping charges, tariffs, and other fees based on your product’s specific HTSUS code

HTS vs. HTSUS: When to Use the First Six Digits?

Did you know that only part of the code is internationally standardized? Let’s look at when you should focus on just the first six digits (known as the HTS or HS code):

| When to Use the 6-Digit HTS Code | Why It Matters |

| International Trading | Creates consistency when dealing with customs authorities worldwide |

| Initial Product Classification | Provides a global perspective on how your product is categorized |

| Starting Point for Country Codes | Forms the foundation before adding country-specific digits |

| Reviewing International Agreements | Many trade agreements reference these standardized six-digit codes |

Remember: While the six-digit code gives you international standardization, you’ll always need the complete ten-digit HTSUS code when importing into the United States. The six-digit portion connects your classification globally.

Who Is Responsible for Incorrect HTS Code Usage?

Here’s something crucial every importer needs to understand: accurate HTSUS classification falls squarely on your shoulders as the importer. Why? Let me explain:

- It’s Your Legal Duty: U.S. law places this responsibility directly on importers, not on your suppliers or freight forwarders

- Documentation Falls to You: You must provide correct classifications on all import entries and security filings

- Mistakes Cost Money: Using the wrong code can lead to incorrect duty payments, financial penalties, and problems with CBP

- The Buck Stops With You: Even if your supplier provides a code or handles duties under DDP terms, you remain responsible if CBP finds errors

- Exercise “Reasonable Care”: Don’t blindly trust third parties for classifications—verify them yourself and document your reasoning

- Your Money at Stake: Accurate identification through HTSUS directly impacts how much you pay in duties and fees

Think of it this way: just as you wouldn’t let someone else file your taxes without verifying the information, you shouldn’t leave HTSUS classification entirely to others when your company bears the legal responsibility.

How Products Get Classified: HTS Code Lookup

What actually determines a product’s HTSUS classification? Three main factors come into play:

- Material Composition: What is your product made of? The materials directly influence classification

- Product Name/Description: The common or commercial name of your product matters, along with detailed descriptions

- Intended Function/Use: How will the product be used? Even similar items can have different classifications based on their purpose

The HTSUS itself follows a logical structure:

| Digit Position | What It Represents | Who Determines It |

| First 2 digits | Chapter number (broad category) | World Customs Organization |

| Digits 3-4 | Heading within chapter | World Customs Organization |

| Digits 5-6 | Subheading (more specific) | World Customs Organization |

| Digits 7-10 | U.S.-specific subclassifications | United States government |

Each level adds more specificity to the classification. The first six digits form the international Harmonized System (HS) framework, while the final four digits represent U.S.-specific tariff requirements.

When classifying your products, you’ll need to compare them against government schedules where different product descriptions receive unique codes. Because HTSUS descriptions can sometimes be ambiguous, always choose codes that match your goods as specifically as possible. For difficult classifications, consider consulting the Customs Rulings Online Search System (CROSS) to see how similar products have been classified in the past.

You can just click on the link below to easily lookup HTS code:

Remember, using the correct codes isn’t just about following rules – it directly impacts your bottom line! Stay updated on code changes, as the system evolves to accommodate new products and technologies.

Are you importing goods into the United States? Make sure you understand both HTS and HTSUS to navigate customs requirements successfully. Your attention to these details can save you time, money, and potential compliance headaches!

FAQ

1- “I’m importing products for the first time. Who is responsible for determining the HTS/HTSUS code – me or my supplier?”

As the importer, you are ultimately responsible for ensuring the correct classification of your goods. While suppliers often provide HTS codes, U.S. Customs and Border Protection (CBP) holds the importer of record accountable for proper classification.

2- “What happens if I use the wrong HTSUS code? Will I get in serious trouble with customs?”

The consequences depend on the circumstances. If CBP determines the misclassification was an honest mistake, they might simply require you to correct the classification and pay any additional duties owed. However, if they believe the error was intentional (to avoid higher duties), you could face penalties up to the domestic value of the merchandise, depending on the level of culpability.

3- “How specific do HTSUS codes get? My product seems to fit in multiple categories.”

When your product seems to fit multiple categories, you need to apply the General Rules of Interpretation (GRI), which provide a systematic approach to classification. GRI 1 is the most important – classification is determined by the terms of the headings and relevant section/chapter notes.

4- “Do HTSUS codes ever change?

Yes, HTSUS codes change regularly! The U.S. International Trade Commission issues updates to the HTSUS throughout the year. Major updates typically occur annually, but modifications can happen more frequently due to trade agreements, legislation, or other factors.

5- How often should I review my classifications?”

As a best practice, review your classifications at least annually and whenever you modify or add new products to your import portfolio. Sign up for automated notifications from CBP or the USITC to stay informed about changes affecting your products.

6- “Can I appeal if I disagree with CBP’s classification of my product?”

Answer: Absolutely! If you disagree with CBP’s classification, you have several options. First, you can file a protest within 180 days of liquidation using CBP Form 19. If your protest is denied, you can further appeal to the Court of International Trade.

7- “I see people talking about ‘binding rulings’ for HTS codes. What are these and should I get one?”

A binding ruling is an official pre-importation decision from CBP regarding the classification of your specific product. You request it by submitting detailed product information through the CROSS (Customs Rulings Online Search System) electronic ruling program. While not mandatory, binding rulings can prevent costly surprises and disputes with CBP.

8- “I keep hearing about ‘Section 301 tariffs’ related to China. How do these interact with normal HTSUS duties?”

Section 301 tariffs are additional duties imposed on certain Chinese-origin goods beyond the normal HTSUS rates. These tariffs (often 7.5%, 15%, or 25%) apply to specific HTSUS codes listed on four different lists. When importing affected products from China, you’ll pay both the regular HTSUS duty rate PLUS the Section 301 additional tariff.

9- “My supplier uses HS codes that are only 8 digits. Is this a problem for U.S. imports?”

This isn’t necessarily a problem, but you’ll need to add the final two digits for U.S. imports. Many countries use 8-digit systems (rather than the U.S. 10-digit system), which is why your supplier might provide 8-digit codes.

10- “I’m importing from a country with a free trade agreement. Do I still need to worry about HTS codes?”

Absolutely! In fact, HTS codes become even more critical when using free trade agreements (FTAs). For your products to qualify for reduced or zero duties under an FTA, they must meet specific origin requirements tied directly to their HTS classifications.

11- “How can I research HTS codes myself instead of paying someone to classify my products?”

You can access the complete HTSUS free of charge on the U.S. International Trade Commission website (https://hts.usitc.gov/). Start by understanding the organizational structure.

12- “What’s the difference between Schedule B codes and HTS codes? My freight forwarder asked for Schedule B numbers.”

While they look similar, Schedule B codes are used for U.S. exports while HTS/HTSUS codes are used for imports. Both systems share the same first 6 digits (the international HS classification), but Schedule B typically uses 10 digits administered by the Census Bureau instead of CBP. When exporting from the U.S., you’ll need Schedule B codes for your Electronic Export Information (EEI) filing.

13- “Can using different HTS codes help me avoid tariffs or get better rates?”

Deliberately misclassifying goods to avoid tariffs is illegal and can result in severe penalties, including fines up to the value of the merchandise, seizure of goods, and even criminal prosecution for fraud.

14- “Do services or digital products need HTS codes?”

HTS codes apply specifically to physical goods crossing borders, not to services or purely digital products. If you’re importing software on physical media (like a DVD), the physical carrier would need an HTS code, but the classification would be based on the media, not the software value. Similarly, if you’re importing a service (like remote IT support), no HTS code is required.

15- “How far back can CBP audit my HTS classifications? I’m worried about past mistakes.”

Answer: CBP generally has five years from the date of entry to review and liquidate entries. However, in cases of alleged fraud, this period can be extended indefinitely. During a Focused Assessment (comprehensive audit), CBP typically examines entries from the previous year but may expand their review further if they find systematic issues.